GHC Funding: Your Comprehensive Guide to SBA Small Business Loans in Alhambra, California

Contact Information:

- GHC Funding: Your Comprehensive Guide to SBA Small Business Loans in Alhambra, California

GHC Funding

833-572-4327

sales@ghcfunding.com

www.ghcfunding.com

Introduction

Alhambra, California, is a vibrant and diverse city located in the San Gabriel Valley region of Los Angeles County. Known for its rich cultural heritage and strong community ties, Alhambra has become a thriving hub for small businesses. Whether you’re looking to start a new venture or expand an existing one, having access to the right financing is crucial. GHC Funding, a leading commercial loan broker, specializes in helping small businesses secure the best financing options available, including SBA loans, term loans, working capital loans, equipment financing, business lines of credit, and commercial real estate (CRE) loans.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

- Understanding Alhambra, California: Population, Demographics, and Economic Landscape

- Financing Options with GHC Funding: No Points, No Fees, Just Success

- Frequently Asked Questions (FAQ)

- Client Success Stories with GHC Funding

- 5 Interesting Facts About Alhambra, California

- Disclaimer

In this detailed guide, we’ll explore everything you need to know about obtaining small business loans in Alhambra, California. We’ll dive into the city’s demographics, economic landscape, and provide examples of loan amortization schedules to help you understand the benefits of the financing options offered by GHC Funding. We’ll also include essential information on how GHC Funding can help you secure the best loan terms, with no points or fees, setting your business up for long-term success.

Understanding Alhambra, California: Population, Demographics, and Economic Landscape

Alhambra is a bustling city with a population of approximately 85,000 residents. The city is characterized by its diverse population, with a significant percentage of residents being of Asian and Hispanic descent. This cultural diversity contributes to a rich and varied local economy, where small businesses thrive in industries ranging from retail and hospitality to professional services and healthcare.

Population and Demographics

As of 2024, Alhambra’s population stands at around 85,000 people, with a median age of 38 years. The city’s residents are highly educated, with over 35% holding a bachelor’s degree or higher. This educated workforce supports a range of industries, making Alhambra an attractive location for businesses looking to tap into a skilled labor pool.

The city’s cultural diversity is one of its most defining features. Approximately 53% of the population identifies as Asian, primarily of Chinese, Vietnamese, and Filipino descent. Another 33% of residents identify as Hispanic or Latino, adding to the multicultural fabric of the community. This diversity is reflected in the wide array of local businesses, from Asian supermarkets and restaurants to Latinx-owned boutiques and service providers.

Economic Landscape

Alhambra’s economy is robust, driven by a mix of small businesses, retail establishments, and professional services. The city’s strategic location near major highways and its proximity to downtown Los Angeles make it a prime spot for businesses looking to serve both local and regional markets.

The retail sector is particularly strong in Alhambra, with numerous shopping centers, restaurants, and small businesses catering to the needs of residents and visitors alike. The city is also home to a growing number of professional service firms, including legal, accounting, and real estate services, which benefit from the city’s educated workforce and business-friendly environment.

Key Zip Codes and Area Highlights

Here are five key zip codes in Alhambra, California, along with some highlights about each area:

- 91801: This is the heart of Alhambra, encompassing the downtown area. It’s a bustling commercial district with a mix of retail, dining, and entertainment options. The area is known for its vibrant nightlife and diverse culinary scene.

- 91803: Located in the southwestern part of the city, this area is more residential but includes significant commercial developments along Fremont Avenue. It’s a prime location for businesses catering to local residents.

- 91802: This zip code is primarily associated with P.O. boxes, serving the broader Alhambra community. It’s an essential part of the city’s postal and business communication infrastructure.

- 91804: Situated in the northeastern part of the city, this area is more suburban with a mix of residential neighborhoods and small businesses. It’s an ideal location for family-oriented businesses and services.

- 91896: This zip code includes part of the western Alhambra area, which is home to several industrial and commercial properties. It’s a hub for businesses in manufacturing, logistics, and wholesale trade.

Financing Options with GHC Funding: No Points, No Fees, Just Success

GHC Funding is a commercial loan broker, not a bank, and this distinction is crucial. As a loan broker, GHC Funding partners with various lenders to secure the best financing terms for small businesses without charging points or fees. This approach ensures that you get the full benefit of the loan without any hidden costs. Let’s explore the various financing options available to small businesses in Alhambra, California.

SBA Loans

SBA loans are a cornerstone of small business financing in Alhambra. Backed by the U.S. Small Business Administration, these loans offer favorable terms and conditions that make them an attractive option for many entrepreneurs.

How SBA Loans Work: SBA loans are partially guaranteed by the government, reducing the risk for lenders and making it easier for small businesses to obtain financing. The most common types of SBA loans include the 7(a) Loan Program, the 504 Loan Program, and the SBA Microloan Program.

- 7(a) Loan Program: This is the SBA’s primary loan program, providing financial assistance for businesses with special requirements. The funds can be used for a variety of purposes, including working capital, purchasing equipment, and refinancing existing debt.

- 504 Loan Program: This program provides long-term, fixed-rate financing for major assets such as real estate or equipment. It’s ideal for businesses looking to expand their operations by purchasing property or significant machinery.

- SBA Microloan Program: The Microloan Program offers small, short-term loans to small businesses and certain non-profit childcare centers. These loans can be used for working capital or the purchase of inventory, supplies, furniture, and fixtures.

Benefits of SBA Loans with GHC Funding: When you work with GHC Funding, you benefit from our expertise in navigating the SBA loan process. We help you prepare your application, ensuring that all necessary documentation is in order, and we work with lenders to secure the best possible terms. Since GHC Funding does not charge points or fees, you’ll receive the full value of the loan without any additional costs.

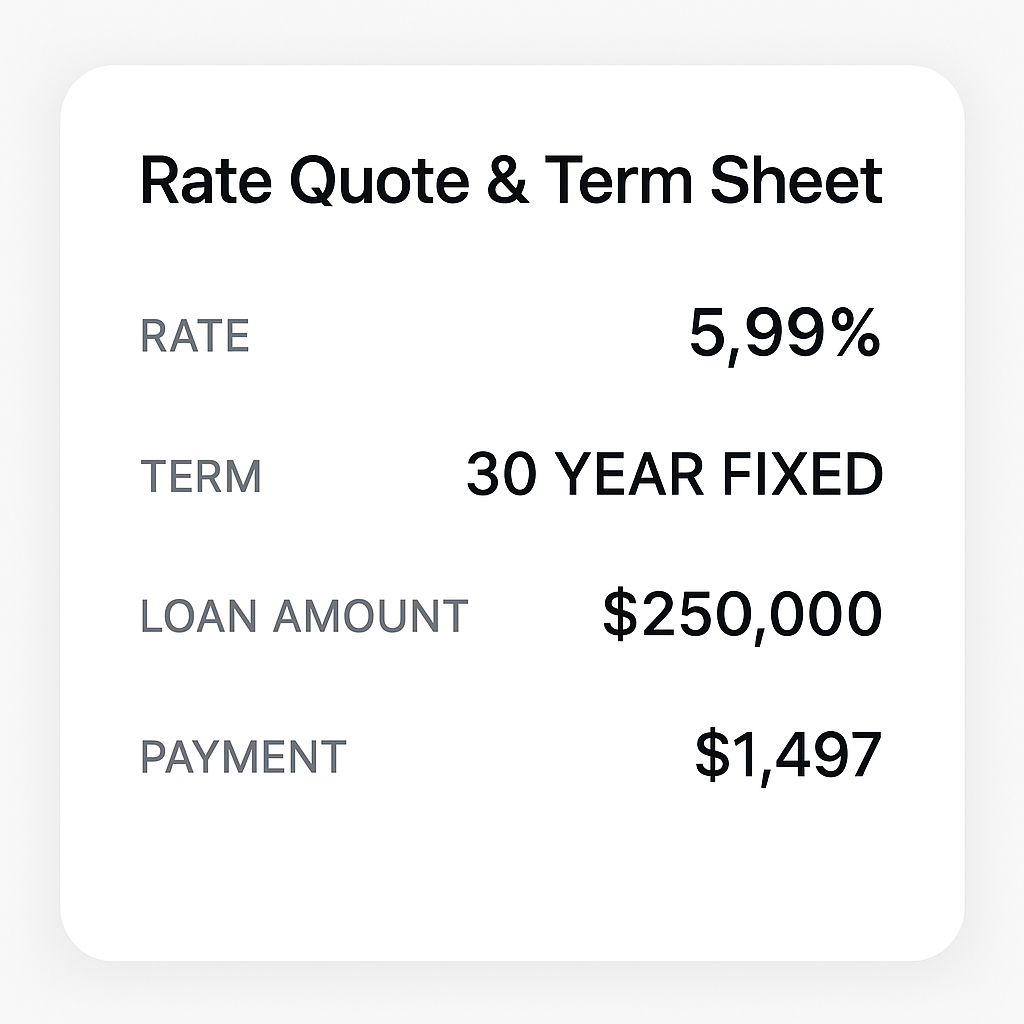

Simplified Example: Let’s say you take out a 0,000 SBA loan with a 10-year term and a fixed interest rate of 6%. Your monthly payment would be approximately $5,556. Over the 10-year period, you would pay a total of $166,720 in interest, bringing the total cost of the loan to $666,720.

If the loan term were extended to 15 years at the same interest rate, your monthly payment would decrease to approximately ,220, but the total interest paid would increase to 8,600, making the total loan cost 8,600. For a 25-year term, the monthly payment would drop further to about $3,221, with total interest paid amounting to $466,300, bringing the total loan cost to $966,300.

This example illustrates how the loan term impacts both monthly payments and the total cost of the loan, helping you choose the option that best fits your business’s cash flow needs.

Term Loans

Term loans provide a lump sum of capital that is repaid over a fixed period, typically with a fixed interest rate. This type of loan is ideal for businesses looking to finance major investments, such as equipment purchases, facility upgrades, or large-scale marketing campaigns.

How Term Loans Work: With a term loan, you receive a lump sum of money upfront, which you then repay over a set period, usually ranging from one to ten years. The repayment schedule is fixed, meaning you’ll have a clear understanding of your monthly obligations.

Benefits of Term Loans with GHC Funding: One of the significant advantages of securing a term loan through GHC Funding is the absence of points or fees. This means that you get the full amount of the loan without any deductions, maximizing the capital available for your business. Additionally, term loans can offer lower interest rates compared to other forms of financing, especially when the loan is secured by collateral.

Simplified Example: Imagine your business takes out a 0,000 term loan with a 5-year term and an interest rate of 7%. Your monthly payment would be approximately $5,940. Over the course of the loan, you would pay $56,400 in interest, bringing the total loan cost to $356,400.

If you opt for a 10-year term at the same interest rate, your monthly payment would decrease to approximately ,484, but the total interest paid would increase to 8,080, making the total loan cost 8,080.

Working Capital Loans

Working capital loans are designed to provide businesses with the necessary funds to cover day-to-day operational expenses, such as payroll, inventory, and utilities. These loans are essential for maintaining smooth operations, especially during periods of fluctuating revenue or seasonal slowdowns.

How Working Capital Loans Work: Unlike term loans, which are typically used for large, one-time expenses, working capital loans are intended for ongoing operational costs. They can be structured as a lump sum or a line of credit, depending on the needs of your business.

Benefits of Working Capital Loans with GHC Funding: The flexibility of working capital loans makes them an attractive option for businesses that need quick access to cash. GHC Funding ensures that you get the full amount of the loan without

any points or fees, allowing you to allocate the funds where they’re needed most.

Simplified Example: Let’s say your business secures a 0,000 working capital loan with a 3-year term and an interest rate of 8%. Your monthly payment would be approximately $3,134. Over the term of the loan, you would pay $12,840 in interest, making the total cost of the loan $112,840.

Equipment Financing

For businesses that rely on specialized equipment, equipment financing provides the capital needed to purchase or lease machinery, vehicles, or technology. This type of financing is particularly useful for industries such as manufacturing, construction, and healthcare.

How Equipment Financing Works: Equipment financing involves borrowing money specifically to purchase or lease equipment. The equipment itself often serves as collateral for the loan, which can lead to lower interest rates compared to unsecured loans.

Benefits of Equipment Financing with GHC Funding: Equipment financing through GHC Funding comes with no points or fees, ensuring that you get the full loan amount to purchase the necessary equipment. Additionally, the equipment can be depreciated over time, offering potential tax benefits.

Simplified Example: Suppose you need to purchase 0,000 worth of equipment and secure a 7-year equipment financing loan with a 5% interest rate. Your monthly payment would be approximately $2,828. Over the term of the loan, you would pay $38,624 in interest, making the total cost of the loan $238,624.

Business Line of Credit

A business line of credit provides ongoing access to funds that you can draw from as needed. This flexible financing option is perfect for managing cash flow fluctuations, covering unexpected expenses, or taking advantage of growth opportunities.

How a Business Line of Credit Works: A business line of credit operates similarly to a credit card. You’re given a credit limit and can draw funds up to that limit as needed. You only pay interest on the amount you’ve drawn, not on the entire credit line.

Benefits of a Business Line of Credit with GHC Funding: The flexibility of a business line of credit is one of its most significant advantages. With GHC Funding, you’ll have access to this flexible financing option without any points or fees, allowing you to manage your business’s cash flow effectively.

Simplified Example: Let’s say you have a business line of credit with a 0,000 limit and a 10% interest rate. If you draw $50,000 and repay it over 12 months, your monthly payment would be approximately $4,396, with a total interest payment of $2,752.

Commercial Real Estate (CRE) Loans

Commercial real estate loans are designed for businesses looking to purchase, refinance, or renovate commercial properties. Whether you’re acquiring a new office space, expanding your retail location, or investing in rental properties, a CRE loan can provide the necessary capital.

How CRE Loans Work: CRE loans are typically long-term loans secured by the commercial property being financed. The terms of these loans can vary widely, depending on the property type, loan amount, and lender requirements.

Benefits of CRE Loans with GHC Funding: Securing a CRE loan through GHC Funding ensures that you receive the full loan amount without any points or fees, maximizing your investment. Additionally, the long-term nature of CRE loans allows for manageable monthly payments, helping you maintain a healthy cash flow.

Simplified Example: Imagine you secure a ,000,000 CRE loan with a 25-year term and an interest rate of 6%. Your monthly payment would be approximately $6,443. Over the term of the loan, you would pay $933,000 in interest, making the total cost of the loan $1,933,000.

Frequently Asked Questions (FAQ)

How do I qualify for a small business loan in Alhambra, California?

Qualifying for a small business loan in Alhambra typically requires a strong credit score, a solid business plan, and sufficient collateral (if applicable). GHC Funding works with you to assess your eligibility and guide you through the application process to increase your chances of approval. For more information, visit the SBA’s official website.

What is the process for applying for an SBA loan?

The process for applying for an SBA loan involves several steps:

- Pre-Qualification: Assess your eligibility based on your credit score, business size, and financials.

- Documentation: Gather necessary documents, including your business plan, financial statements, and tax returns.

- Application: Complete the SBA loan application with the help of GHC Funding.

- Review and Approval: The lender reviews your application, and if approved, you’ll receive the loan terms.

- Disbursement: Once the loan is approved, funds are disbursed, and you can use them for your business needs.

GHC Funding will assist you every step of the way, ensuring that your application is complete and accurately reflects your business’s strengths.

How can GHC Funding help my business grow?

GHC Funding provides a wide range of financing options tailored to your business’s unique needs. Whether you need working capital, equipment financing, or a commercial real estate loan, our team works with you to secure the best possible terms and guide you through the entire process.

Client Success Stories with GHC Funding

Case Study 1: Expanding a Family-Owned Restaurant

A family-owned restaurant in Alhambra needed financing to expand its seating capacity and update its kitchen equipment. GHC Funding secured an SBA loan with favorable terms, allowing the business to complete the renovations without straining its cash flow. Today, the restaurant is thriving, with a 40% increase in customer traffic and revenue.

Case Study 2: Financing for a Local Retail Boutique

A local retail boutique in Alhambra wanted to expand its inventory and improve its online presence. GHC Funding provided a term loan that covered the cost of inventory expansion and a website redesign. As a result, the boutique saw a 50% increase in online sales and a 30% increase in foot traffic.

Case Study 3: Real Estate Investment for a Small Business Owner

A small business owner in Alhambra sought financing to purchase a commercial property for their growing business. GHC Funding facilitated a commercial real estate loan that allowed the owner to acquire the property and make necessary renovations. The new location has significantly improved the business’s visibility and customer base.

5 Interesting Facts About Alhambra, California

- Historical Significance: Alhambra was founded in 1903 and is named after Washington Irving’s book “Tales of the Alhambra.” The city has a rich history, with several historic landmarks, including the Alhambra Civic Center and the San Gabriel Mission.

- Diverse Culinary Scene: Alhambra is known for its diverse culinary offerings, particularly its Asian cuisine. The city has become a destination for food lovers, with a wide range of restaurants serving Chinese, Japanese, Vietnamese, and Thai dishes.

- Cultural Events: Alhambra hosts several cultural events throughout the year, including the annual Lunar New Year Festival, which attracts visitors from all over Southern California.

- Educational Institutions: The city is home to several highly regarded educational institutions, including Alhambra High School and California State University, Los Angeles, which is located just a short drive away.

- Proximity to Los Angeles: Alhambra’s strategic location just eight miles from downtown Los Angeles makes it an attractive place to live and do business. Residents and business owners enjoy easy access to the amenities and opportunities of a major metropolitan area while benefiting from the charm and community of a smaller city.

GHC Funding Contact Information

GHC Funding

833-572-4327

sales@ghcfunding.com

www.ghcfunding.com

Virtual Address: 1000 Fremont Ave, Suite 204, Alhambra, CA 91803

Disclaimer

This blog post is for informational purposes only and does not constitute financial advice. Please consult with a financial advisor or loan specialist to discuss your specific circumstances and options.

In this comprehensive guide, we’ve explored the various small business financing options available to entrepreneurs in Alhambra, California, with a focus on SBA loans, term loans, working capital loans, equipment financing, business lines of credit, and commercial real estate loans. With GHC Funding as your partner, you can secure the best loan terms without the burden of points or fees, ensuring that your business has the capital it needs to thrive. Whether you’re looking to expand your operations, purchase new equipment, or invest in commercial property, GHC Funding is here to help you achieve your business goals.

GHC Funding

833-572-4327

sales@ghcfunding.com

www.ghcfunding.com

Virtual Address: 1000 Fremont Ave, Suite 204, Alhambra, CA 91803

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources