Fix and Flip Construction Loans in Ohio Now 2025

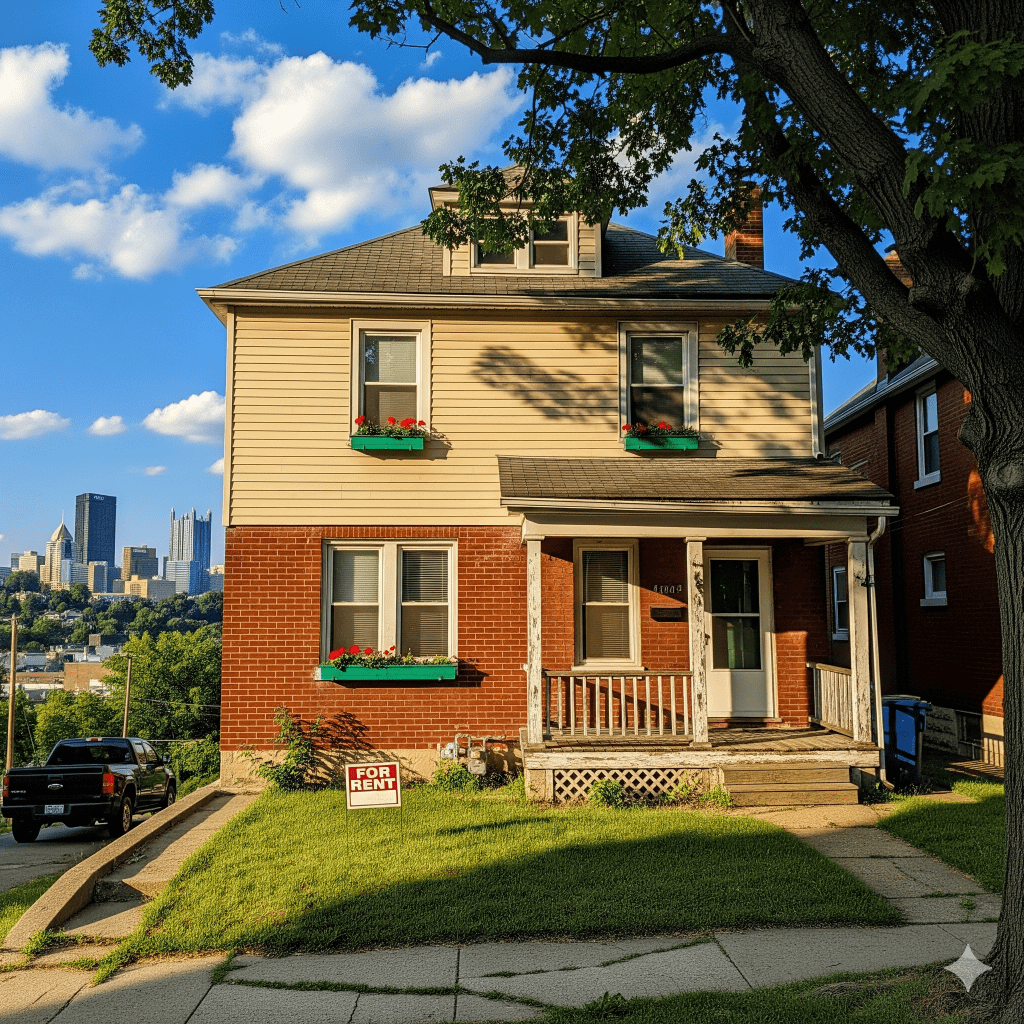

Get 2025 fix and flip construction loans in Ohio for 1-4 unit rentals. Compare rates, terms & lenders for investment properties. Fast approval process.

Fix and Flip Construction Loans in Ohio Now 2025 Read More »