Contributing Author & Editorial Review

This article was authored and professionally reviewed to provide accurate, actionable financial insights.

GHC Funding

Contributing Author

Alyssa writes about real estate investing, debt-free strategies, and emerging trends in small business finance with a focus on practical insights.

Samantha Reyes

Senior Content Editor

Samantha specializes in editorial strategy, compliance review, and refining complex finance topics into accessible, reader-friendly guidance.

DSCR Rental Loan Highlights

- Qualification based mainly on property cash flow (DSCR).

- No personal income docs required for many programs.

- Financing for 1–8 unit rentals, portfolios, and many STR/Airbnb deals.

- Up to 80% LTV on purchases and 75% LTV on cash-out (program-dependent).

- 30-year fixed and interest-only options available.

Bare Minimum Mondays 2025: How Austin Companies Embrace the Anti-Hustle Productivity Trend

In 2025, the trend of Bare Minimum Mondays has gained significant traction in Austin workplaces. This innovative approach allows employees to focus only on essential tasks at the start of the week, offering a much-needed reprieve from the anxiety-inducing ‘Sunday Scaries’ and pushing back against the pervasive hustle culture.

- Bare Minimum Mondays 2025: How Austin Companies Embrace the Anti-Hustle Productivity Trend

- The Psychology of Sunday Scaries

- Understanding the Anti-Hustle Movement

- How Austin Companies Are Adapting

- Case Studies: Success Stories in Austin

- The Impact on Employee Wellness

- Statistics and Trends

- Practical Strategies for Implementation

- Conclusion

The Psychology of Sunday Scaries

Many employees experience the ‘Sunday Scaries,’ a form of weekend anxiety that stems from anticipating the workweek ahead. This phenomenon is often fueled by the pressure to perform and the fear of falling behind. Bare Minimum Mondays provide a psychological cushion, allowing individuals to transition smoothly into their workweek, thereby reducing stress and anxiety.

Understanding the Anti-Hustle Movement

The anti-hustle movement challenges the traditional notion that constant productivity is the only path to success. Instead, it promotes sustainable work practices that prioritize mental health and work-life balance. In Austin, this cultural shift is evident as more companies recognize the benefits of allowing their employees to ease into the week.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

How Austin Companies Are Adapting

Progressive employers in Austin are leading the charge by implementing policies that support Bare Minimum Mondays. These include:

- No meetings before 10 AM on Mondays: This policy allows employees to start their week with focus and clarity.

- Essential tasks only: Employees are encouraged to prioritize critical tasks, reducing overwhelm.

- Flexible work hours: Companies provide flexibility to accommodate personal needs and preferences.

Case Studies: Success Stories in Austin

Several Austin-based companies have successfully implemented Bare Minimum Mondays:

- Tech Innovators Inc.: By adopting a ‘no meetings Monday’ policy, they reported a 20% increase in productivity and a 15% improvement in employee satisfaction.

- Green Solutions LLC: Focused on essential tasks, they observed reduced burnout and a 30% decrease in employee turnover.

The Impact on Employee Wellness

The mental health benefits of Bare Minimum Mondays are substantial. Employees report feeling less anxious, more balanced, and better able to manage their workloads throughout the week. This approach aligns with the growing emphasis on mental health in the workplace, especially in a post-pandemic world where burnout and ‘quiet quitting’ have become prevalent.

Statistics and Trends

Recent studies indicate that companies adopting Bare Minimum Mondays see improvements in various areas:

- Productivity increased by an average of 18% over the week.

- Employee satisfaction scores rose by 22%.

- Retention rates improved by 25%.

Practical Strategies for Implementation

For companies looking to embrace this trend, the following strategies are recommended:

- Communicate clearly: Ensure all employees understand the purpose and benefits of Bare Minimum Mondays.

- Set boundaries: Encourage employees to identify and prioritize essential tasks.

- Encourage manager support: Managers should model and support this approach to ensure its success.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

Construction Loan Lenders and Process in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Opportunities: Navigating Construction Loan Lenders in Florida…

Read more →

Get The SBA Express Loan Application in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Simplifying the SBA Express Loan Application Process in…

Read more →

Get SBA 7(a) or 504 loan in New York Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read SBA 7(a) vs 504 Loans: Navigating Business Financing…

Read more →

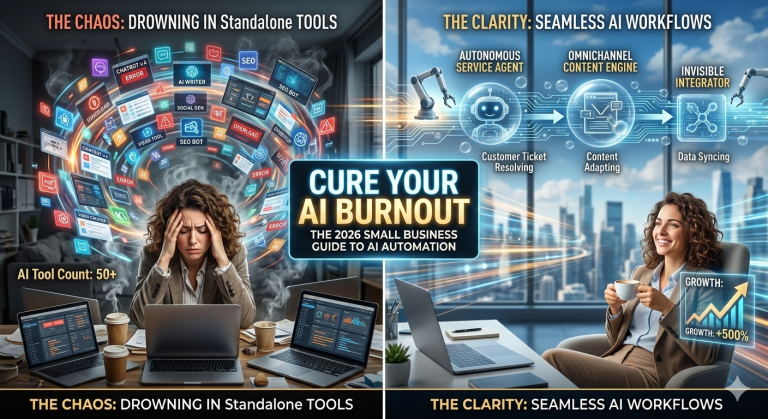

2026 Guide to AI for Small Business: Tools & Scaling Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 6 minutes read The 2026 Guide to…

Read more →

DSCR Loan Calculator with Taxes in New York Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Business Potential: Understanding…

Read more →

The Entrepreneurial Finance in 2026: Liquidity & AI Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 4 minutes read The New Rules of…

Read more →Conclusion

Bare Minimum Mondays represent a significant shift in workplace culture, aligning with the values of the modern workforce. As Austin companies continue to embrace this trend, they are not only enhancing productivity but also fostering a healthier, more sustainable work environment. By prioritizing employee well-being, these organizations are paving the way for a future where work-life balance is not just a goal but a reality.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources