Contributing Author & Editorial Review

This article was crafted and reviewed by experienced professionals to ensure accuracy and practical insight.

Construction & Renovation Highlights

- Financing for ground-up builds and major rehab projects.

- Works for SFR, small multifamily, and select mixed-use/commercial.

- Up to 85–90% of project costs and 70–75% of completed value (case-by-case).

- Interest-only during the build phase for improved cash flow.

Get Your Construction Project Off the Ground with GHC Funding’s Construction Loans in Georgia

As a Georgia business owner, you know that the construction industry in our state is booming. From Atlanta to Savannah, construction projects are constantly popping up, creating opportunities for businesses to grow and thrive. However, with all the potential for success also comes the need for financial support. That’s where GHC Funding’s construction loans come in. We understand the unique challenges and opportunities that come with construction projects in Georgia and are here to provide the funding you need to make your vision a reality.

- Get Your Construction Project Off the Ground with GHC Funding’s Construction Loans in Georgia

- The Story of a Georgia Business Owner

- What are Construction Loans?

- Real Market Conditions in Georgia

- The Details of Construction Loans

- Real Case Study: Construction Loan in Atlanta

- Frequently Asked Questions about Construction Loans

- Ready to Get Started?

The Story of a Georgia Business Owner

Meet Sarah, a business owner in Atlanta who has been in the construction industry for over a decade. She has always dreamt of expanding her business and taking on larger projects, but lacked the necessary funds to do so. With the recent growth of the construction market in Georgia, Sarah saw an opportunity to finally make her dreams a reality. However, she quickly realized that securing funding for a construction project is not as easy as she had thought.

After being turned down by several traditional lenders due to her credit score, Sarah was feeling discouraged and unsure of how to move forward. That’s when she came across GHC Funding’s construction loans. She was hesitant at first, but after doing some research and speaking with our team, she decided to apply for a loan. To her surprise, she was approved and was able to secure the funding she needed to take on her biggest project yet.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

Today, Sarah’s construction company is thriving and she has expanded her team to take on even more projects throughout Georgia. She credits GHC Funding for playing a huge role in her success and highly recommends our construction loans to other business owners in the industry.

What are Construction Loans?

Construction loans are short-term loans that are specifically designed for businesses in the construction industry. These loans provide the necessary funds to cover the costs of a construction project, including labor, materials, equipment, and more. Unlike traditional loans, construction loans are typically disbursed in stages as the project progresses, rather than as a lump sum upfront.

At GHC Funding, we offer construction loans for a variety of projects, including new construction, renovations, and expansions. Our loans range from ,000 to million and we work with businesses of all sizes in cities all across Georgia, including Atlanta, Savannah, Augusta, and more.

Who Needs Construction Loans?

Construction loans are specifically designed for businesses in the construction industry, including general contractors, subcontractors, and even suppliers. Any business that needs funding to cover the costs of a construction project can benefit from a construction loan. Whether you are looking to take on bigger projects, expand your business, or simply need help with cash flow during a construction project, a construction loan can provide the financial support you need.

Why Do Georgia Businesses Benefit from Construction Loans?

In Georgia, the construction industry is flourishing. According to the Atlanta Business Chronicle, Georgia ranks third in the nation for the number of construction projects underway. With so many opportunities for growth and success in the construction industry, businesses in Georgia need a reliable source of funding to take advantage of these opportunities. That’s where GHC Funding’s construction loans come in. We provide quick and flexible funding options that are tailored to meet the specific needs of businesses in Georgia. Our loans can help you stay competitive in this booming market and take your business to the next level.

Real Market Conditions in Georgia

Georgia has seen significant growth in the construction industry in recent years. According to the Associated General Contractors of America, Georgia added 11,600 construction jobs just in the past year. This growth is expected to continue, with major projects planned in cities like Atlanta, Savannah, and Augusta.

However, with this growth also comes challenges. The competition in the construction industry in Georgia is fierce, and businesses need to be able to keep up with the demand in order to succeed. This is where GHC Funding’s construction loans can give you an edge over your competitors. With our quick and flexible funding options, you can have the financial support you need to take on more projects and grow your business.

The Details of Construction Loans

Credit Score Requirements

One of the most common questions we get from business owners is about credit score requirements for construction loans. While credit score is definitely a factor in the loan approval process, it is not the only factor we consider. At GHC Funding, we understand that credit scores can fluctuate, and we look at the overall financial health of your business and the potential for success of your construction project. That being said, a credit score of at least 620 is typically required for our construction loans.

Approval Timeframe

We know that time is of the essence when it comes to construction projects, which is why we strive to provide quick and efficient funding options. Our approval process typically takes between 1 to 2 weeks, but can vary depending on the complexity of the project and the completeness of the application. We are dedicated to working closely with our clients to ensure a smooth and timely approval process.

Common Mistakes Georgia Business Owners Make

Based on our experience working with businesses in the construction industry in Georgia, we have identified a few common mistakes that business owners make when seeking construction loans:

- Not having a clear and detailed business plan or project proposal.

- Not being prepared with all necessary financial documents and information.

- Not considering all the costs and expenses associated with the project.

- Not seeking multiple funding options and limiting themselves to traditional lenders.

At GHC Funding, our team is here to guide you through the loan application process and help you avoid these mistakes. We want to see your business succeed and will work with you to ensure that your loan application is strong and complete.

Real Case Study: Construction Loan in Atlanta

One of our clients, a general contractor in Atlanta, came to us seeking a million construction loan for a new project in the city. They had been turned down by other lenders due to their credit score, but we saw the potential for success in their business and their project. After a thorough review of their application, we approved their loan and provided funding within 2 weeks.

Over the next 6 months, our client was able to complete their project on time and within budget, thanks to the financial support provided by our construction loan. The project was a huge success and our client was able to take on even more projects with the increased capacity of their business. Today, they continue to work with us for their funding needs and have become one of our most valued clients.

Frequently Asked Questions about Construction Loans

1. Can I use a construction loan for any type of construction project?

Yes, our construction loans can be used for various types of construction projects, including new construction, renovations, and expansions.

2. How much funding can I get with a construction loan?

At GHC Funding, our construction loans range from $50,000 to $5 million. The amount you can get will depend on the size and complexity of your project, as well as the overall financial health of your business.

3. How long does it take to get approved for a construction loan?

Our approval process typically takes between 1 to 2 weeks, but can vary depending on the complexity of the project and the completeness of the application.

4. What happens if my project goes over budget?

If your project goes over budget, you can work with our team to request additional funding. We understand that unexpected expenses can arise during a construction project and we are here to support you throughout the process.

5. Can I use my own materials for the project?

Yes, you can use your own materials for the project. Our construction loans cover all costs associated with the project, including labor, materials, equipment, and more.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

Get The SBA Express Loan Application in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Simplifying the SBA Express Loan Application Process in…

Read more →

Get SBA 7(a) or 504 loan in New York Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read SBA 7(a) vs 504 Loans: Navigating Business Financing…

Read more →

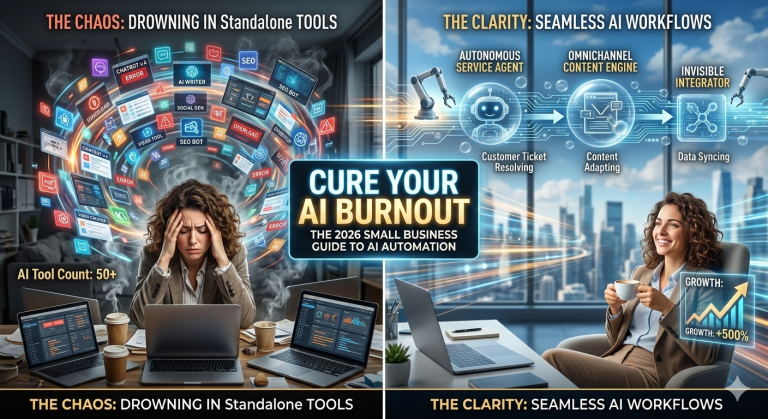

2026 Guide to AI for Small Business: Tools & Scaling Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 6 minutes read The 2026 Guide to…

Read more →

DSCR Loan Calculator with Taxes in New York Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Business Potential: Understanding…

Read more →

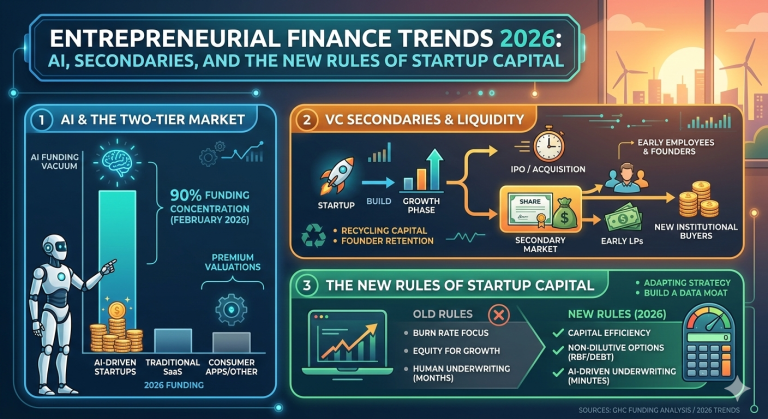

The Entrepreneurial Finance in 2026: Liquidity & AI Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 4 minutes read The New Rules of…

Read more →

Get The Entrepreneurial Finance Trends 2026 Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 8 minutes read Entrepreneurial Finance Trends 2026:…

Read more →Ready to Get Started?

If you are a business owner in the construction industry in Georgia, don’t let lack of funding hold you back from achieving your goals. Contact GHC Funding today and let us help you secure the construction loan you need to take your business to the next level. Our team of experienced professionals is dedicated to providing quick and flexible funding options tailored to your specific needs. Let us be your partner in success in the booming construction market in Georgia.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources