Financial Modeling 2025: Charlotte Companies Master 5-Year Pro Forma & Strategic Projections for Growth

In 2025, Charlotte businesses are facing unprecedented economic volatility, heightened investor scrutiny, and the paramount need for resilient growth strategies. In this environment, robust financial modeling and business planning have emerged as pillars for forward-thinking organizations seeking to attract capital, plan for the long haul, and adapt to changing market realities.

- Financial Modeling 2025: Charlotte Companies Master 5-Year Pro Forma & Strategic Projections for Growth

- The Strategic Imperative: Why 5-Year Financial Projections Matter

- 2025 Trends in Financial Modeling for Charlotte Businesses

- Case Study: Charlotte Tech Startup Raises Series B with Bulletproof 5-Year Model

- Best Practices for Financial Projections & Pro Forma Models

- 2025 Economic Uncertainty: Charlotte’s Local Context

- Advanced Techniques: Sensitivity Analysis, Monte Carlo, and More

- Real-World Application: Financial Modeling for Strategic Planning & Investment

- Common Challenges—And How Charlotte Companies Overcome Them

- Investor-Ready Presentations: What Investors in Charlotte Expect in 2025

- Actionable Insights for Charlotte Business Owners and CFOs

- Conclusion: The Path Forward

The Strategic Imperative: Why 5-Year Financial Projections Matter

5-year financial projections are no longer just ‘nice-to-have’ documents for Charlotte enterprises—they have become boardroom essentials. These models enable companies to:

- Demonstrate long-term viability to investors and lenders

- Anticipate cash requirements and funding gaps before they arise

- Set credible milestones aligned with strategic growth objectives

- Navigate uncertainty by stress-testing assumptions over diverse economic scenarios

2025 Trends in Financial Modeling for Charlotte Businesses

- Integrated Scenario Modeling: Incorporating macroeconomic and regional uncertainty—such as Fed policy, supply chain dynamics, and local workforce trends—into driver-based projections.

- Data-Driven Decision Making: Leveraging real-time data integrations (e.g., from Xero, Quickbooks, NetSuite) for living models that evolve with the business.

- Investor Readiness: Developing institution-grade outputs—robust 5-year pro forma financial statements, dynamic dashboards, and sensitivity analysis for due diligence rounds.

- Cloud-Based Collaboration: Adoption of cloud platforms (e.g., Fathom, Jirav, Cube) by Charlotte CFOs for real-time co-building and scenario planning.

Case Study: Charlotte Tech Startup Raises Series B with Bulletproof 5-Year Model

In early 2025, Carolina SmartHomes Inc. set out to secure a $20M Series B round. Their turning point? A comprehensive, driver-based 5-year financial model. Key features included:

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

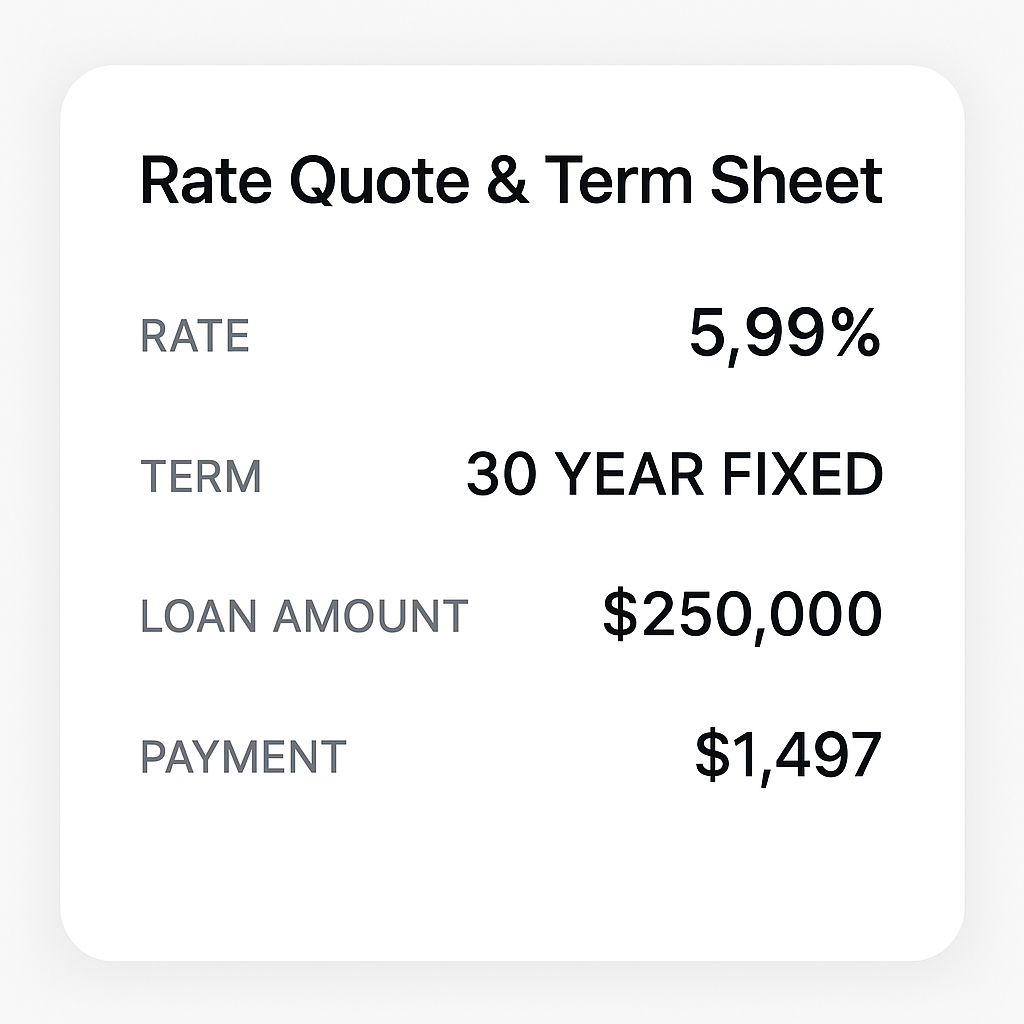

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

Equipment Financing for Construction Company in NC Now!" loading="lazy" srcset="https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd-1024x1024.jpeg 1024w, https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd-300x300.jpeg 300w, https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd-150x150.jpeg 150w, https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd-768x768.jpeg 768w, https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd-1536x1536.jpeg 1536w, https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd.jpeg 2048w" sizes="auto, (max-width: 1024px) 100vw, 1024px" />

Equipment Financing for Construction Company in NC Now!" loading="lazy" srcset="https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd-1024x1024.jpeg 1024w, https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd-300x300.jpeg 300w, https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd-150x150.jpeg 150w, https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd-768x768.jpeg 768w, https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd-1536x1536.jpeg 1536w, https://ghcfunding.com/wp-content/uploads/2025/05/Gemini_Generated_Image_lcmdlylcmdlylcmd.jpeg 2048w" sizes="auto, (max-width: 1024px) 100vw, 1024px" />

- Detailed revenue build: Segmenting residential, commercial, and government contracts, with tailored growth drivers for each

- Dynamic expense schedules: Linking hiring plans and R&D investments directly to sales milestones

- Capital allocation scenarios: Modeling the impact of higher/faster funding and potential headwinds (interest rates, supply chain costs)

- Automated dashboarding: Real-time updates on key KPIs (ARR, burn rate, EBITDA margins) for investors

Result: Carolina SmartHomes not only closed their round within six weeks, but also gained credibility with strategic partners—enabling geographic expansion into Atlanta and the Research Triangle.

Best Practices for Financial Projections & Pro Forma Models

- Adopt Driver-Based Modeling

Anchor revenue and cost forecasts to tangible business levers: units sold, customer acquisition rates, pricing dynamics, etc. This ensures your models reflect operational reality. - Use Scenario and Sensitivity Analysis

Don’t present a single view—show base, optimistic, and downside cases. Use sensitivity tables and tornado charts to highlight how key assumptions (e.g., customer churn, cost inflation) affect outcomes. - Integrate Cash Flow Forecasting

Forecast cash runway, funding needs, and working capital movements month-by-month, not just annually, to preempt liquidity crunches. - Ensure Data Accuracy and Assumption Transparency

Document your model’s logic and sources. Back up every key input (market size, conversion rates, cost escalations) with data or a rationale. - Embrace Agile, Collaborative Tools

Use cloud-based apps or advanced Excel/Google Sheets frameworks with role-based permissions, audit trails, and version controls for transparency and cross-team alignment.

2025 Economic Uncertainty: Charlotte’s Local Context

Charlotte continues to benefit from:

- Growing fintech and tech startup ecosystems

- A resilient real estate and logistics sector

- A vibrant healthcare and biotech presence

But regional challenges include:

- Rising wage pressures and talent competition, especially in banking and tech

- Housing market volatility impacting consumer spending and construction firms

- Lingering supply chain disruptions for manufacturing and distribution companies

Modern financial models in Charlotte increasingly reflect these realities via dynamic assumptions and contingency planning.

Advanced Techniques: Sensitivity Analysis, Monte Carlo, and More

- Sensitivity Analysis: Quantify how small changes in inputs (e.g., customer growth rate) impact key outcomes (revenue, EBITDA). Essential for risk-aware CFOs.

- Monte Carlo Simulation: Model several thousand possible outcomes—using random variable generation for uncertain drivers—to estimate probabilities of outcomes (e.g., hitting cash break-even).

- Rolling Forecasts: Rather than static annual budgets, update your 5-year projections every quarter with YTD performance and revised market data.

Real-World Application: Financial Modeling for Strategic Planning & Investment

Charlotte’s mid-market manufacturing firm, Piedmont Automation LLC, revamped their 5-year projections to support a $10M bank facility and a $5M mezzanine investment:

- Developed staggered hiring and capacity ramp-up models, informed by customer order trends and historical lead times

- Forecasted capital equipment investment paybacks under high and low-volume scenarios

- Included inflation, raw material cost, and interest rate variation cases with scenario toggling

- Created concise visual dashboards for lenders and PE investors, focused on DSCR, IRR, and cumulative cash flow

Outcome: Their well-supported projections accelerated loan approval and improved negotiating position with new equity partners.

Common Challenges—And How Charlotte Companies Overcome Them

- Data Integrity: Investing in automated data pulls from ERP and CRM systems to minimize errors

- Assumption Validation: Regularly benchmarking model drivers versus peer companies and published industry datasets

- Scenario Complexity: Utilizing modular, layered model structures for fast scenario switching without breaking formulas

- Cross-functional Engagement: Involving business line leaders in model building improves accuracy and buy-in

Investor-Ready Presentations: What Investors in Charlotte Expect in 2025

- Clear, logical model structure: Inputs, assumptions, and outputs separated cleanly; linked to one version of truth

- Transparent, defendable assumptions: Justified with third-party data, market studies, or proven historicals

- Model flexibility: Ability to instantly run new scenarios at investor request, demonstrating deep command of the business

- Cohesive storytelling with data visuals: Use of dashboards, charts, and focused summaries to supplement detailed financials

- Governance and audit trail: Maintaining evidence of model changes and version control to enhance trust

Actionable Insights for Charlotte Business Owners and CFOs

- Start with a clear business logic before building spreadsheets—map how each revenue and cost driver links to strategy.

- Invest in integrated cloud modeling tools for scalability, ease of updates, and real-time scenario analysis.

- Schedule periodic ‘assumption reviews’ with your executive team at least quarterly.

- Prepare concise model summaries and sensitivity analyses for board and investor presentations.

- Leverage local advisory firms (e.g., Charlotte-based fractional CFOs and FP&A specialists) to stress-test models and ready them for fundraising.

Conclusion: The Path Forward

In 2025, Charlotte companies that invest in robust, dynamic 5-year financial modeling will enjoy outsized advantages—both in attracting investment and navigating economic uncertainty. The best models are more than calculations: they are strategic tools, trusted by leadership, that align daily operations with long-term vision. The key is not just technical accuracy, but clarity, defensibility, and the agility to adapt as Charlotte’s business climate evolves.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources