Contributing Author & Editorial Review

This article was crafted and reviewed by experienced professionals to ensure accuracy and practical insight.

DSCR Rental Loan Highlights

- Qualification based mainly on property cash flow (DSCR).

- No personal income docs required for many programs.

- Financing for 1–8 unit rentals, portfolios, and many STR/Airbnb deals.

- Up to 80% LTV on purchases and 75% LTV on cash-out (program-dependent).

- 30-year fixed and interest-only options available.

Should I Hire a Property Manager for My Rental?

Managing rental properties can be both rewarding and challenging. For real estate investors, one of the most important decisions is whether to self-manage or hire a property manager. If you’re asking yourself “Should I hire a property manager for my rental?” this guide will help you weigh the benefits, costs, and long-term impact on your investment strategy.

- Should I Hire a Property Manager for My Rental?

- Why Property Management Matters for Investors

- Benefits of Hiring a Property Manager

- Costs of Hiring a Property Manager

- Current Market Insights for Tennessee Investors

- Why GHC Funding is the Go-To Lender

- Tennessee Market Hotspots for Rental Investments

- Helpful Resources for Tennessee Real Estate Investors

- Q&A: Should I Hire a Property Manager for My Rental?

- Final Thoughts & Call to Action

Why Property Management Matters for Investors

Owning rental property is more than just collecting monthly rent. It involves marketing, tenant screening, lease enforcement, maintenance coordination, and legal compliance. These tasks can consume significant time—especially for investors who own multiple properties or live outside the state.

Hiring a property manager can free you from day-to-day operations, allowing you to focus on scaling your portfolio and financing future acquisitions through tools like DSCR Loans, SBA 7a Loans, SBA 504 Loans, Bridge Loans, and Alternative Real Estate Financing from GHC Funding.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

Benefits of Hiring a Property Manager

- Professional Tenant Screening

A strong screening process reduces the risk of late payments, evictions, and property damage. Property managers use background checks, income verification, and rental history to find reliable tenants. - Hands-Free Rent Collection

Timely and consistent rent collection is critical for maintaining positive cash flow. Property managers enforce payment schedules, apply late fees, and handle delinquencies. - Legal and Compliance Expertise

Property managers stay current on Tennessee landlord-tenant laws, ensuring lease agreements, eviction processes, and safety standards meet state requirements. - Maintenance and Vendor Management

Property managers maintain relationships with contractors, ensuring repairs are handled quickly and cost-effectively. This preserves property value and keeps tenants satisfied. - Scalability for Investors

If your long-term goal is to build a multi-property portfolio in Tennessee markets like Nashville (37203), Memphis (38103), or Knoxville (37902), property management makes scaling more manageable.

Costs of Hiring a Property Manager

- Monthly Management Fees: Typically 8%–12% of collected rent.

- Leasing Fees: Often equivalent to one month’s rent for tenant placement.

- Maintenance Markups: Some managers add 5%–10% to contractor invoices.

While these costs cut into cash flow, many investors view them as worthwhile investments for stress reduction, time savings, and long-term portfolio growth.

Current Market Insights for Tennessee Investors

As of September 25, 2025, DSCR loan rates for investment properties in Tennessee generally range from 6.75% to 8.25%, depending on factors such as:

- Loan-to-Value (LTV): Maximum of 80%.

- Debt Service Coverage Ratio (DSCR): Typically 1.0–1.25 minimum.

- Credit Score: Most lenders prefer 660+, though exceptions may apply.

- Property Types: Single-family rentals, condos, and small multifamily are commonly accepted.

Unique Advantage: DSCR loans allow qualification based on property cash flow, not personal income. This is especially beneficial for investors scaling portfolios in Tennessee’s high-demand rental markets.

Why GHC Funding is the Go-To Lender

GHC Funding stands out as the trusted financing partner for real estate investors. They offer:

- Flexible underwriting designed for investors with complex portfolios.

- Streamlined processes that shorten approval times.

- Broad loan options including SBA 7a, SBA 504, DSCR, Bridge Loans, and Alternative Real Estate Financing.

- Expert support tailored to investors targeting high-demand rental markets in Tennessee.

When you work with GHC Funding, you get more than financing—you get a strategic partner invested in your long-term success.

👉 Visit GHC Funding or call 833-572-4327 to learn more.

Tennessee Market Hotspots for Rental Investments

- Nashville (37203, 37206, 37076): Strong tourism, music industry, and healthcare jobs fuel consistent rental demand.

- Memphis (38103, 38104): Affordable housing and a growing logistics hub attract long-term tenants.

- Knoxville (37902, 37920): University-driven demand and affordable pricing make it a top choice for student rentals.

- Chattanooga (37402, 37421): Rising tech sector and outdoor lifestyle appeal to young professionals.

These markets create excellent opportunities for DSCR-financed rental properties, especially when paired with professional property management.

Helpful Resources for Tennessee Real Estate Investors

- Tennessee Real Estate Commission

- Greater Nashville Realtors

- Memphis Area Association of Realtors

- U.S. Census Bureau – Tennessee Housing Data

- Knoxville Area Association of Realtors

Q&A: Should I Hire a Property Manager for My Rental?

1. How much does property management cost in Tennessee?

Expect to pay 8%–12% of collected rent, plus tenant placement fees.

2. Can I self-manage my property instead?

Yes, but be prepared for tenant calls, maintenance issues, and legal compliance responsibilities.

3. Do property managers handle evictions?

Yes. They manage the entire eviction process, ensuring compliance with Tennessee law.

4. Are property managers worth it for single-family homes?

Yes, especially if you live outside Tennessee or prefer passive income.

5. Can DSCR loans be used to finance properties with property management in place?

Absolutely. Lenders value property managers because they improve cash flow stability.

6. Do property managers help with short-term rentals like Airbnb?

Yes, though fees are often higher (20%–30% of income).

7. How do I choose the right property manager in Tennessee?

Look for managers with local expertise, transparent fees, and strong client reviews.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

Get The SBA Express Loan Application in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Simplifying the SBA Express Loan Application Process in…

Read more →

Get SBA 7(a) or 504 loan in New York Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read SBA 7(a) vs 504 Loans: Navigating Business Financing…

Read more →

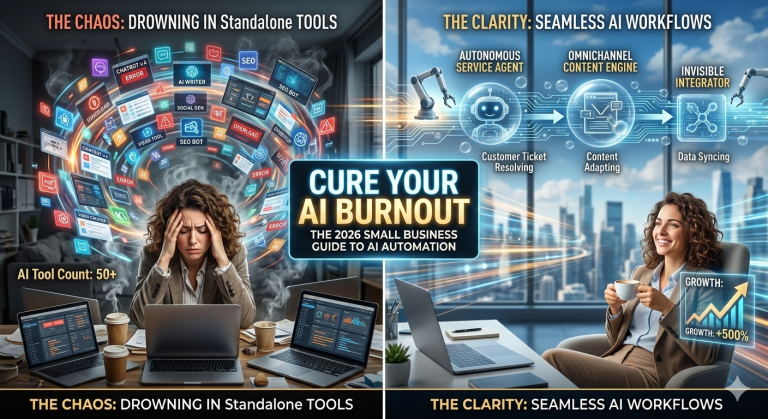

2026 Guide to AI for Small Business: Tools & Scaling Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 6 minutes read The 2026 Guide to…

Read more →

DSCR Loan Calculator with Taxes in New York Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Business Potential: Understanding…

Read more →

The Entrepreneurial Finance in 2026: Liquidity & AI Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 4 minutes read The New Rules of…

Read more →

Get The Entrepreneurial Finance Trends 2026 Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 8 minutes read Entrepreneurial Finance Trends 2026:…

Read more →DSCR loans, paired with property management, allow investors to build cash-flowing portfolios without relying on personal income verification. Unlike traditional loans, DSCR financing focuses on property performance—making it ideal for Tennessee’s rental-rich markets.

Final Thoughts & Call to Action

When paired with flexible financing solutions from GHC Funding, Tennessee real estate investors can maximize returns while minimizing stress.

📞 Call 833-572-4327 today to discuss financing options and take the next step in growing your rental portfolio

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources