Contributing Author & Editorial Review

This article was crafted and reviewed by experienced professionals to ensure accuracy and practical insight.

DSCR Rental Loan Highlights

- Qualification based mainly on property cash flow (DSCR).

- No personal income docs required for many programs.

- Financing for 1–8 unit rentals, portfolios, and many STR/Airbnb deals.

- Up to 80% LTV on purchases and 75% LTV on cash-out (program-dependent).

- 30-year fixed and interest-only options available.

Smart Property Management & Tenant Screening AI in Charlotte: Complete 2025 Guide for Real Estate Investors

Last Updated: 2025

- Smart Property Management & Tenant Screening AI in Charlotte: Complete 2025 Guide for Real Estate Investors

- Introduction: The Rise of AI in Charlotte Real Estate

- What Makes Charlotte’s Real Estate Market Unique in 2025?

- How AI is Revolutionizing Smart Property Management in 2025

- AI-Powered Tenant Screening in Charlotte: 2025 Innovations

- Step-by-Step Guide: Implementing AI Property Management in Charlotte

- Charlotte Market Data: 2025 Statistics

- Case Studies: AI-Driven Property Management Success Stories in Charlotte

- Forecasts & Expert Predictions for 2025 and Beyond

- Actionable Insights for Charlotte Real Estate Investors

- Conclusion: Seizing the AI Advantage in Charlotte Real Estate

Introduction: The Rise of AI in Charlotte Real Estate

Charlotte, North Carolina stands as a premier gateway to the modern South—one of the fastest-growing cities in the US, with a thriving business district, dynamic job market, and an influx of young professionals and families. In 2025, investors are discovering that Artificial Intelligence (AI) is fundamentally transforming every aspect of property management and tenant screening in Charlotte’s competitive real estate landscape.

This comprehensive guide explores how AI-powered solutions are reshaping property management and tenant screening, making it easier, faster, and safer for investors and landlords to maximize returns while mitigating risks in Charlotte’s booming property markets.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

What Makes Charlotte’s Real Estate Market Unique in 2025?

- Fastest-Growing Urban Centers: Uptown neighborhoods, South End, and NoDa are experiencing double-digit YOY rent growth and record-low vacancy rates.

- High Competition for Quality Tenants: Due to population surge (+1.6% YOY) and a tech-driven workforce, tenant quality and retention are higher-stakes issues than ever.

- Tech-Friendly Market: Charlotte’s reputation as a fintech/innovation hub means landlords, tenants, and investors are especially receptive to digital-first solutions.

How AI is Revolutionizing Smart Property Management in 2025

1. Automated Lease Lifecycle Management

AI platforms now manage the entire lease lifecycle—from applicant vetting to move-out inspection—reducing operational hours by up to 62% for property managers. Algorithms trigger rent reminders, flag maintenance issues, and auto-generate renewal offers based on tenant scoring and current market data.

2. Predictive Maintenance Scheduling

AI sensors and IoT-enabled systems (like SmartRent, AppFolio AI, or Building Engines) analyze usage patterns to predict appliance failures, optimize energy consumption, and dispatch vendors proactively. In Charlotte’s humid climate, predictive A/C and mold prevention AI can save investors $1,800–$2,600/unit/yr in emergency repair expenses.

3. Virtual Concierge Tools

AI chatbots and virtual assistants streamline communication between managers, tenants, and service providers, enabling 24/7 self-service for everything from rent payments to visitor access—crucial in a city where over 35% of renters are in the 25–34 age bracket and expect digital convenience.

AI-Powered Tenant Screening in Charlotte: 2025 Innovations

Charlotte’s tight rental market—where average days-on-market for desirable properties fell below 14 in Q1 2025—demands faster, more accurate tenant vetting. AI-driven screening tools offer:

- Hyperlocal Credit & Risk Scoring: AI blends FICO, rental history, income data, and proprietary risk signals to create nuanced, Charlotte-specific decision models that outperform generic background checks.

- Fraud Detection: Modern screening engines use machine learning to flag ID forgeries, fake paystubs, and AI-generated documents in real-time.

- Fair Housing Compliance: Algorithmic transparency features ensure adherence to North Carolina statutes and federal Fair Housing regulations, minimizing the risk of bias or discrimination claims.

Step-by-Step Guide: Implementing AI Property Management in Charlotte

- Assess Portfolio Needs: Multi-family, single-family, and mixed-use assets have differing requirements; size and class impact which AI tools provide the best ROI.

- Select an AI Platform:

- Best for Small Investors: Turbotenant AI, RentSpree AI

- Mid-Market & Institutional: AppFolio AI+, Buildium SmartSuite, Yardi Voyager AI

- Enterprise & Large Portfolios: Entrata AI Suite, RealPage AI, ResMan AI

- Integrate Data Sources: Sync lease, payment, maintenance, and local market data streams for holistic automation. Tap into Charlotte’s MLS, county records, and rent roll APIs where available.

- Deploy AI Screening: Activate AI-powered screening with custom local parameters (e.g., minimum credit scores, income multiples reflecting the Charlotte cost-of-living index).

- Monitor & Optimize: Continuously train models using portfolio performance data to refine tenant profiles and management workflows.

Charlotte Market Data: 2025 Statistics

- Average effective rent: $1,630/month (up 9.1% YOY)

- Rental vacancy rate: 4.2% (vs. US avg 6.3%)

- Median days-on-market: 13

- Eviction rate: Down 23% YOY since AI-powered screening adoption accelerated (2022–2025)

Case Studies: AI-Driven Property Management Success Stories in Charlotte

Case Study 1: Streamlining Single-Family Rentals (Investment: $120K)

Scenario: A Charlotte-based investor with eight single-family homes implemented AppFolio’s AI Tenant Screening and virtual assistant in 2024. Result: Tenant turnover dropped by 17%, delinquency fell below 1%. Net operating income increased by $6,800/year due to minimized vacancy and maintenance savings.

Case Study 2: Multi-Family Asset Optimization (Investment: $310K)

Scenario: A regional real estate fund managing a newly built, 48-unit apartment in South End adopted Yardi Voyager AI Suite for predictive maintenance and dynamic rent pricing. Result: 70% reduction in after-hours maintenance calls, 9% higher lease renewal rate, and a 4.5% YOY NOI lift, outpacing market peers.

Case Study 3: Boutique Portfolio Scalability (Investment: $65K)

Scenario: A local owner-operator with 15 vintage duplexes introduced RentSpree AI for fraud detection and automated communication. Result: Screening time cut from 2.5 days to 4 hours, zero missed payment incidents in 18 months, and a 22% improvement in online tenant reviews.

Forecasts & Expert Predictions for 2025 and Beyond

- AI adoption rate: Over 75% of Charlotte portfolios over 20 units projected to use AI-powered management or screening by end of 2025.

- Ongoing Fair Housing scrutiny: Expect increased AI transparency and audit requirements—choose vendors who offer model explainability and compliance assurances.

- Data privacy: North Carolina legislation will mandate stricter data handling, so investors should confirm vendor compliance.

- Competitive edge: Early AI adopters report net cash yield premiums of 1.2–1.5% over the city’s median, due to lower delinquency, reduced admin workload, and smarter renewals.

Actionable Insights for Charlotte Real Estate Investors

- Pilot AI screening tools for your next 5–10 units to benchmark improvements in vacancy and default rates.

- Automate maintenance scheduling for assets vulnerable to climate or system failures—especially older buildings or those with legacy equipment.

- Integrate rent collection & communication AI to align with Charlotte’s digitally savvy tenant base.

- Review all AI vendor compliance & bias mitigation features before committing to a platform.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

2026 Guide to AI for Small Business: Tools & Scaling Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 6 minutes read The 2026 Guide to AI for Small Business:…

Read more →

DSCR Loan Calculator with Taxes in New York Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Business Potential: Understanding DSCR Loan Calculators with…

Read more →

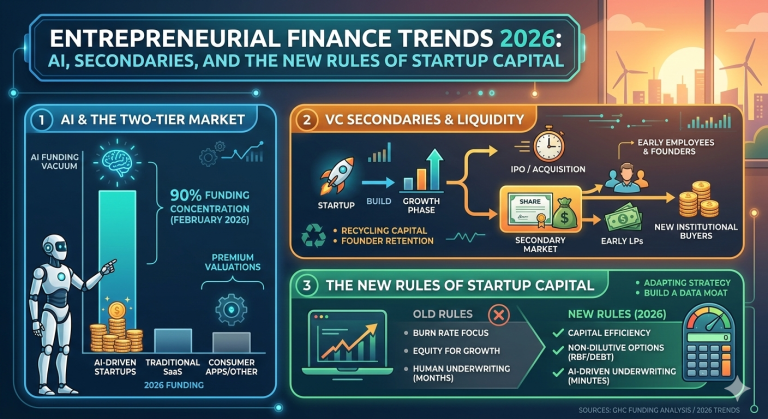

The Entrepreneurial Finance in 2026: Liquidity & AI Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 4 minutes read The New Rules of Entrepreneurial Finance 2026: Liquidity,…

Read more →

Get The Entrepreneurial Finance Trends 2026 Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 8 minutes read Entrepreneurial Finance Trends 2026: AI, Secondaries, and the…

Read more →

Best DSCR Lenders in Mississippi Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 3 minutes read Top DSCR Lenders for Real Estate Investors in…

Read more →

The Construction Loan Interest Rates in Mississippi Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 4 minutes read Understanding Construction Loan Interest Rates in Mississippi: A…

Read more →Conclusion: Seizing the AI Advantage in Charlotte Real Estate

For 2025 and beyond, Charlotte’s high-growth market uniquely benefits from AI-powered property management and tenant screening. Investors who embrace these technologies now can expect to boost returns, minimize risk, and position themselves ahead of the competitive curve as the Queen City continues to flourish. The time to act is now—pilot, automate, and scale with AI-driven precision.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources