Contributing Author & Editorial Review

This article was crafted and reviewed by experienced professionals to ensure accuracy and practical insight.

SBA 7(a) & 504 Highlights

- Loan amounts from $100,000 up to $15 million+ (program-dependent).

- Up to 90% financing for eligible acquisitions, real estate, and equipment.

- Use funds for working capital, refinance, expansion, and partner buyout.

- Longer terms (up to 25 years on real estate) to keep payments manageable.

Industrial Outdoor Storage Revolution 2025: How Indianapolis Is Meeting the Growing Demand for Construction Equipment Storage & Infrastructure Development

Introduction: The Booming Need for Industrial Outdoor Storage (IOS) in 2025

The Indianapolis region is witnessing a dramatic rise in demand for Industrial Outdoor Storage (IOS)—sites optimized for truck parking, container storage, and especially the storage of construction equipment. With the acceleration of e-commerce, infrastructure investment, and supply chain reshoring continuing into 2025, low-coverage industrial land is now one of the hottest—and most misunderstood—assets in commercial real estate.

- Industrial Outdoor Storage Revolution 2025: How Indianapolis Is Meeting the Growing Demand for Construction Equipment Storage & Infrastructure Development

- The 2025 Market Context: Why Construction Equipment Storage Has Become Critical

- What Makes an IOS Site? The Essentials in Indianapolis

- 2025 Demand Drivers: Case Studies from Indianapolis

- Zoning Patterns & Regulatory Issues: Indianapolis Specifics

- Cash Flow Analysis: The Massive Opportunity in “No Building” Sites

- Latest Trends (2025): How Construction & Supply Chain Shape IOS Demand

- Financing Options: Unlocking Value for Investors and Operators

- Development and Investment Strategies for 2025

- Actionable Insights for Investors, Developers, and Lenders

- Conclusion: Indianapolis as a Growth Epicenter for IOS in 2025

The 2025 Market Context: Why Construction Equipment Storage Has Become Critical

Several macroeconomic and market-specific trends drive the exponential need for IOS in Indianapolis:

- Infrastructure Investment and Development: The federal government’s slate of infrastructure bills has led to billions in new projects—roads, bridges, warehouses—across Indiana.

- Growing Construction Firms: Local and national contractors are expanding, necessitating secure, accessible sites for heavy machinery and material laydown yards.

- Land Scarcity: Traditional industrial warehouse space remains expensive; low-coverage IOS sites present a scalable alternative.

What Makes an IOS Site? The Essentials in Indianapolis

- Paved/Yard Space: 2–20+ acres of secure, hard-surfaced land.

- Minimal Building Coverage: Small offices, wash bays, or maintenance sheds—often under 10% FAR (Floor Area Ratio).

- Access to Major Highways: Quick ingress/egress to the I-70/I-465 corridor, critical for equipment mobilization.

- Heavy Vehicle Tolerances: Reinforced surfaces for cranes, earthmovers, and rental equipment.

2025 Demand Drivers: Case Studies from Indianapolis

Case Study 1: The Construction Fleet Hub

Client: Indiana Earthmoving, a regional contractor

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

Challenge: Project timelines and penalties mean every hour counts. Storing fleets across multiple jobsites led to inefficiencies and security risks.

Solution: Indiana Earthmoving secured a 12-acre IOS site near Plainfield with secure fencing, LED yard lighting, and 24/7 access. The property housed 50+ trucks, 20 excavators, and dozens of attachments—all in one place, streamlining dispatch operations and slashing overhead costs.

Case Study 2: Equipment Rental and Industrial Growth

Client: Hoosier Rentals, a construction equipment rental company

Challenge: Demand for rental equipment spiked, but storing large boom lifts, generators, and portable offices on separate properties inflated logistics expenses.

Solution: By leasing a 7-acre IOS parcel just off I-465, Hoosier Rentals centralized their inventory, accelerating turnaround and expanding their regional footprint—leading to a 40% jump in annualized cash flow.

Zoning Patterns & Regulatory Issues: Indianapolis Specifics

Challenges: In Marion County and surrounding suburbs, IOS sites face tight zoning restrictions. Many parcels are old industrial or light-manufacturing zones, but “no building” sites often trigger permit disputes or pushback from neighboring uses due to noise, runoff, or traffic.

Best Practice: Seasoned IOS developers engage local officials early, pursue PUDs (Planned Unit Developments) when necessary, and invest in landscaping and stormwater mitigation—winning community support and fast-tracking approvals.

- Key Zoning Strategies:

- Target I-2 and I-3 industrial districts with proven outdoor equipment use

- Leverage variances for paving or fencing requirements

- Negotiate long-term ground leases in legacy industrial parks

Cash Flow Analysis: The Massive Opportunity in “No Building” Sites

Revenue Drivers for IOS:

- Monthly rent per acre often equals or exceeds older industrial warehouse rates (in core corridors like Park Fletcher, $6,000–$12,000/acre/month is common)

- Multiple tenant types: contractors, equipment companies, logistics, utilities

- Ancillary fees: premium fencing, LED lighting, security, trailer plug-ins, and long-term lease escalation clauses

Cost Structure: Maintenance is limited to pavement repairs, security, and occasional grading or drainage work—creating ultra-high net operating margins. Many sites see margins over 75% of gross receipts.

Bank Lending Challenges: Traditional banks hesitate because “no warehouse” means lower appraisals and perceived risk. Yet, tenant credit quality and lease renewal rates are often superior to older warehouse product.

Latest Trends (2025): How Construction & Supply Chain Shape IOS Demand

- E-Commerce Drives Turnkey Construction: Indy’s topography and logistics infrastructure keep fueling mammoth warehouse and last-mile hubs, making construction equipment storage a keystone for ongoing builds.

- Equipment Technology: Demand for yard power (EV charging for equipment, telematics) makes modern IOS sites hard infrastructure for contractors aiming to be more sustainable and efficient.

- Hybrid Usage: More landowners pair IOS with small flex buildings for on-site management teams or rental counter operations.

Financing Options: Unlocking Value for Investors and Operators

1. Private Credit: Filling the Lending Gap

Because banks remain risk-averse, private investors, debt funds, and family offices are active:

- Loan-to-value (LTV) often 60–70%

- Interest rates in the 8–11% range for stabilized “no-building” IOS assets, with non-recourse options available

- Flexible underwriting focused on lease quality, not building SQFT

2. SBA 504 Loans: Underappreciated Tool for IOS Acquisition & Expansion

- SBA now recognizes IOS use cases (fleet, equipment, container) as eligible for owner-user purchase

- Up to 90% LTV for qualified owner-operators

- Low long-term fixed rates (mid-6% to low-7%, 2025 averages)

Example: A growing local contractor recently acquired a $2.4M, 8-acre IOS site using an SBA 504, committing only $240,000 in equity—freeing up capital for equipment expansion.

Development and Investment Strategies for 2025

- Identify Underutilized Parcels: Old trucking/rail laydown yards or legacy tank farms

- Perform environmental due diligence (Phase I/II ESA)

- Upgrade security, paving, and lighting as needed

- Pre-Lease Before Purchase:

- Line up anchor tenants for 50%+ site coverage pre-acquisition

- Offer Flexible Lease Terms:

- Month-to-month or short term for seasonal construction surges

- Long-term for national contractors and equipment rental firms

- Partner with Local Unions and Trade Schools:

- Training yards double as revenue streams while supporting community workforce goals

Actionable Insights for Investors, Developers, and Lenders

- Embrace Nontraditional Valuations: Use DCF models based on in-place rents and lease quality, not just land comp sales.

- Partner with Experienced Operators: Contractors and logistics players with strong balance sheets make ideal anchor tenants, reducing risk for lenders and private capital.

- Track Policy and Infrastructure Pipelines: Sites near major INDOT projects or logistics corridors are most valuable—monitor public bid lists and permit pipelines.

- Document Zoning Compliance: Keep full zoning, lease, and site improvement files for potential refinancing or disposition. IOS deals with clear entitlement command premium pricing.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

Construction Loan Lenders and Process in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Opportunities: Navigating Construction Loan Lenders in Florida…

Read more →

Get The SBA Express Loan Application in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Simplifying the SBA Express Loan Application Process in…

Read more →

Get SBA 7(a) or 504 loan in New York Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read SBA 7(a) vs 504 Loans: Navigating Business Financing…

Read more →

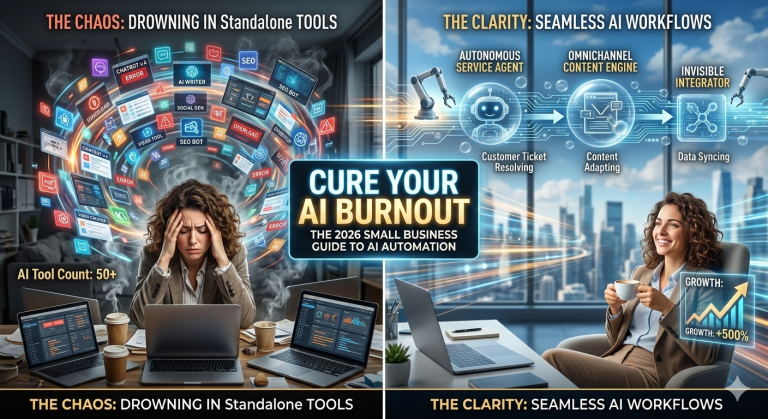

2026 Guide to AI for Small Business: Tools & Scaling Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 6 minutes read The 2026 Guide to…

Read more →

DSCR Loan Calculator with Taxes in New York Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Business Potential: Understanding…

Read more →

The Entrepreneurial Finance in 2026: Liquidity & AI Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 4 minutes read The New Rules of…

Read more →Conclusion: Indianapolis as a Growth Epicenter for IOS in 2025

While Indianapolis’s industrial landscape evolves, so do the opportunities for innovative real estate professionals. Industrial Outdoor Storage—specifically low-coverage sites for construction equipment—offers unmatched cash flow potential, flexible use, and resilience in any part of the economic cycle. Yet, success requires understanding local zoning, adapting to new financing realities, and moving quickly as key corridors get gobbled up. For forward-thinking investors, developers, and lenders, 2025 is the year to make IOS a cornerstone of your industrial strategy in Indianapolis.

Ready to capitalize?

Secure your position in this high-growth, high-margin asset class—connect with an IOS specialist and explore your options for private credit, SBA 504 financing, and strategic site selection tailored to the demands of Indianapolis’s booming construction and infrastructure sectors.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources