Contributing Author & Editorial Review

This article was authored and professionally reviewed to provide accurate, actionable financial insights.

GHC Funding

Contributing Author

Alyssa writes about real estate investing, debt-free strategies, and emerging trends in small business finance with a focus on practical insights.

Samantha Reyes

Senior Content Editor

Samantha specializes in editorial strategy, compliance review, and refining complex finance topics into accessible, reader-friendly guidance.

DSCR Rental Loan Highlights

- Qualification based mainly on property cash flow (DSCR).

- No personal income docs required for many programs.

- Financing for 1–8 unit rentals, portfolios, and many STR/Airbnb deals.

- Up to 80% LTV on purchases and 75% LTV on cash-out (program-dependent).

- 30-year fixed and interest-only options available.

AI-Driven Investing & Stock Analysis: The 2025 Guide for El Paso Investors

Welcome to the ultimate 2025 guide for AI-powered stock analysis and algorithmic trading strategies, tailored for El Paso investors. As algorithmic trading and artificial intelligence (AI) continue to reshape financial markets, local investors are uniquely positioned to tap into leading-edge technologies to optimize portfolios and outperform traditional investment benchmarks.

- AI-Driven Investing & Stock Analysis: The 2025 Guide for El Paso Investors

- Why El Paso Investors Should Embrace Algorithmic Trading and AI

- 2025: State of AI & Algorithmic Trading in the Financial Markets

- Algorithmic Trading Strategies: What Works in 2025?

- Step-by-Step: How to Implement AI-Driven Trading Strategies

- 2025’s Top AI Stock Analysis and Algorithmic Tools

- Portfolio Construction in the Age of AI: 2025 Best Practices

- Case Study: El Paso Investor Harnesses AI for Consistent Alpha

- AI Reliability, Explainability, and Regulatory Considerations (2025)

- Personalizing Your AI-Driven Strategy in El Paso

- Actionable Takeaways for 2025

Why El Paso Investors Should Embrace Algorithmic Trading and AI

- Reduced Human Bias: AI-driven systems help eliminate cognitive biases that hinder manual stock selection.

- Access to Advanced Insights: Leverage powerful analytics previously reserved for hedge funds and Wall Street professionals.

- Automation: Free up time by automating complex tasks such as trade execution, risk monitoring, and rebalancing.

- Competitive Edge: Outperform traditional investors by utilizing the latest data-driven market intelligence.

2025: State of AI & Algorithmic Trading in the Financial Markets

The surge of generative AI, massive cloud computing, and improved regulatory clarity have driven an unprecedented wave of sophisticated algorithmic trading systems in 2025:

- Ultra-Fast Execution: Enhanced by edge AI chips and fiber-optic infrastructure, trades execute within microseconds.

- Multifactor ML Models: Portfolios use dozens of real-time factors—macro, sentiment, technicals, ESG—for stock selection and sizing.

- Regulatory-Ready Algorithms: New compliance modules automatically adjust strategies to meet SEC, FINRA, and Texas Securities Board regulations.

- Democratization: Platforms like QuantConnect, Alpaca, and Tradestation now feature user-friendly AI strategy templates for Main Street traders in El Paso.

Algorithmic Trading Strategies: What Works in 2025?

1. Machine-Learning Enhanced Momentum Strategies

- Model: Gradient-boosted decision trees identify persistent trend signals from 100+ technical features.

- Deployment: Automated position sizing and stop-loss rules fine-tuned by reinforcement learning.

- Performance (Case Study): 2024-2025 S&P momentum portfolio (leveraged 1.2x) achieved a 17.2% annualized return with a max drawdown of 7.5%.

2. Multi-Asset Mean Reversion Algorithms

- Model: LSTM neural nets spot asset pairs that diverge from historical correlations.

- Deployment: Automated trade executions trigger rebalancing of ETF, equity, and crypto baskets.

- Performance (Case Study): Texas multi-asset mean-reversion ETF account yielded 13.8% (2024), outperforming a 60/40 benchmark.

3. Sentiment-Powered Trading Bots

- Model: NLP-driven APIs aggregate social media, news, and regulatory filings for sentiment scores.

- Deployment: Algo signals initiate trades or hedge positions intraday in reaction to sentiment spikes.

- Performance (Case Study): FAANG news-sentiment bot captured an extra 2.6% alpha (Q1 2025) during market anomalies.

Step-by-Step: How to Implement AI-Driven Trading Strategies

- Define Investment Goals: Clarify your target risk (volatility, max drawdown) and objective (growth, income, hedging).

- Choose an AI Platform: In 2025, leading brokerages for El Paso investors include Alpaca, Interactive Brokers, QuantConnect, and TradeStation—all offering modules for algorithmic scripting and backtesting.

- Select or Build an Algorithm: Start with a prebuilt model (momentum, mean reversion, options-based). Advanced users can customize via Python or no-code interfaces.

- Backtest Rigorously: Run multi-year simulations with walk-forward validation. Ensure parameter robustness and monitor for overfitting.

- Automate Risk Management: Set up automatic stop-losses, dynamic position sizing, and portfolio rebalancing rules.

- Deploy Live (Paper Trade First): Go live in simulation mode for several weeks before full capital deployment.

- Monitor and Adapt: Use AI-driven dashboards for real-time P&L, risk analytics, and drawdown alerts.

2025’s Top AI Stock Analysis and Algorithmic Tools

- QuantConnect: Cloud-based backtesting, hundreds of open source AI algorithms, live brokerage integrations.

- TradeStation & EasyLanguage AI: El Paso users get Texas-specific market data and configurable algorithmic modules.

- Alpaca: Commission-free trading with AI-based trade optimization, perfect for retail quants.

- Numerai Signals: Open data for AI model submissions—build your own predictive equity signals and compete for returns.

- Sentiment Investor: Real-time NLP engine for news/social sentiment analysis, integrated with major broker APIs.

- Bloomberg Terminal with ML Suite: For advanced traders, includes real-time data and AI analytics tools covering major Texas equities.

Portfolio Construction in the Age of AI: 2025 Best Practices

- Factor Diversification: Blend strategies (momentum, value, sentiment) to reduce correlation across AI models.

- Automated Rebalancing: Set up regular AI-driven rebalancing to adapt to shifting market regimes (bull, bear, sector rotation).

- Dynamic Hedge Overlays: Combine volatility and tail-risk hedges (e.g., S&P puts) automatically triggered by model forecasts.

- Local vs. Global Exposure: For El Paso, weigh Texas-based stocks and regional ETFs alongside global technology leaders for geographic balance.

Case Study: El Paso Investor Harnesses AI for Consistent Alpha

| Portfolio Type | Traditional (2024 Return) | AI-Driven (2024-25 Return) | Max Drawdown |

|---|---|---|---|

| 60/40 Balanced | 7.8% | 11.2% | 10.8% |

| All-Equity | 10.1% | 14.7% | 13.9% |

| AI-Enhanced Multi-Strategy | N/A | 18.4% | 8.1% |

An El Paso investor combined QuantConnect’s momentum bot, a sentiment overlay, and dynamic hedging, achieving risk-adjusted outperformance versus both local and national benchmarks in 2024-25.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

AI Reliability, Explainability, and Regulatory Considerations (2025)

- Reliability: Algorithmic error handling and real-time trade monitors protect against runaway trading or market anomalies.

- Explainability: New XAI (explainable AI) modules help you interpret trading decisions (feature importance, trade attribution).

- Compliance: Modern platforms automatically align with SEC Reg SCI, FINRA surveillance, and Texas-specific reporting.

- Oversight: Many El Paso financial advisors are now AI-certified and can offer oversight and regulatory guidance for automated strategies.

Personalizing Your AI-Driven Strategy in El Paso

El Paso’s growing tech scene and proximity to key financial hubs empower local investors with unique access to data, networking, and advisory services. By leveraging regional ETFs, considering local economic drivers (energy, logistics, cross-border commerce), and staying informed through Texas-focused financial events, investors can tailor AI-based strategies to maximize relevance and effectiveness.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

Construction Loan Lenders and Process in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Opportunities: Navigating Construction Loan Lenders in Florida…

Read more →

Get The SBA Express Loan Application in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Simplifying the SBA Express Loan Application Process in…

Read more →

Get SBA 7(a) or 504 loan in New York Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read SBA 7(a) vs 504 Loans: Navigating Business Financing…

Read more →

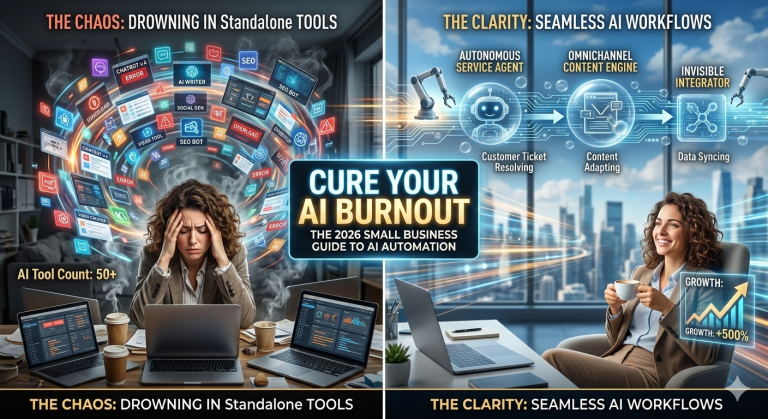

2026 Guide to AI for Small Business: Tools & Scaling Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 6 minutes read The 2026 Guide to…

Read more →

DSCR Loan Calculator with Taxes in New York Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Business Potential: Understanding…

Read more →

The Entrepreneurial Finance in 2026: Liquidity & AI Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 4 minutes read The New Rules of…

Read more →Actionable Takeaways for 2025

- Start Small: Test new algorithmic strategies with minimal capital and paper trading modes to validate models in live conditions.

- Leverage Community: Join El Paso’s quant and investing meetups or online forums like QuantConnect and Numerai to exchange strategies and insights.

- Stay Informed: Monitor 2025 AI and trading regulatory updates, especially as new SEC/FINRA/Texas requirements emerge.

- Embrace Continuous Learning: The most effective investors iterate on models and stay ahead with ongoing AI education.

Ready to transform your investment process? In 2025, algorithmic trading and AI analysis offer El Paso’s investors unprecedented potential for risk-managed returns. Begin exploring today—automate, analyze, and thrive in the new age of intelligent investing.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources