Fix and Flip Construction Loans in Colorado: 2025 Guide for 1-4 Unit Rentals

In Colorado’s vibrant 2025 housing market, investors and landlords are tapping into new opportunities with fix and flip construction loans for 1-4 unit rental properties. Whether you’re interested in single-family homes in Denver, duplexes in Colorado Springs, or small multi-family properties in Fort Collins, understanding the right financing solutions gives you a competitive edge. This comprehensive guide explores Colorado’s best fix and flip loans, construction and rehab financing options, lender recommendations, key investment areas, and step-by-step approval strategies tailored for the modern investor.

- Fix and Flip Construction Loans in Colorado: 2025 Guide for 1-4 Unit Rentals

- Why Consider Fix and Flip & Construction Loans for 1-4 Unit Rentals in Colorado?

- Types of Investment Property Loans for 2025

- Colorado’s Top Neighborhoods & Cities for 1-4 Unit Rental Investments

- Featured Colorado Lenders for 1-4 Unit Residential Construction & Rehab Loans (2025)

- Typical 2025 Loan Terms for Colorado 1-4 Unit Fix & Flip / Construction Loans

- Step-by-Step: How to Get Approved for a Fix & Flip or Construction Loan in Colorado (2025)

- Success Stories: Fix & Flip and Construction Loans in Colorado

- 2025 Colorado Fix & Flip / Construction Loan FAQs

- Takeaways: Succeeding with Fix & Flip / Construction Loans in Colorado (2025)

Why Consider Fix and Flip & Construction Loans for 1-4 Unit Rentals in Colorado?

- Rapid Population Growth: Colorado’s population growth fuels strong demand for updated rental housing, especially in metros and growing suburbs.

- Market Appreciation: Cities like Denver, Boulder, and Fort Collins continue to see property appreciation, increasing the ROI for value-add investments.

- Diverse Inventory: From classic bungalows to new three-unit townhomes, 1-4 unit opportunities abound.

- Tax Benefits & Cash Flow: Rentals offer steady income, depreciation, and capital gains potential when using smart financing.

Types of Investment Property Loans for 2025

- Fix & Flip Loans: Short-term, interest-only bridge loans designed to quickly acquire, renovate, and resell or refinance properties.

- Construction Loans: Finance ground-up or major additions/teardowns, released in phases as work is completed.

- Rehab Loans: Support cosmetic or structural upgrades, ideal for value-add rental strategies.

- Hard Money Loans: Asset-based, fast-closing loans with flexible underwriting and higher LTVs for unique projects.

- DSCR Rental Loans: Debt Service Coverage Ratio loans for stabilized rentals, based on cash flow instead of personal income.

Colorado’s Top Neighborhoods & Cities for 1-4 Unit Rental Investments

Choosing the right location maximizes cash flow and appreciation. Here are top local investment areas:

- Denver’s Sunnyside & West Colfax: Exploding popularity among young professionals, with historic duplexes and SFH fixers.

- Aurora’s Del Mar Parkway: Strong rental demand, ample supply of older fourplexes prime for renovation.

- Colorado Springs’ Old North End: Abundance of classic homes ripe for flips and BRRRR strategies.

- Fort Collins Midtown: College rental hotspot; duplex and triplex inventory near CSU.

- Boulder’s Goss-Grove: Desirable rental market with cottage and small multi-family appeal.

- Pueblo’s Belmont: Value play for quadplexes and small-lot infill construction.

- Grand Junction: Growth area with affordable SFRs and excellent rental yields.

Featured Colorado Lenders for 1-4 Unit Residential Construction & Rehab Loans (2025)

There are nationally recognized and local private lenders actively providing fix & flip and construction loans for 2025 projects. Here are 5 reputable options:

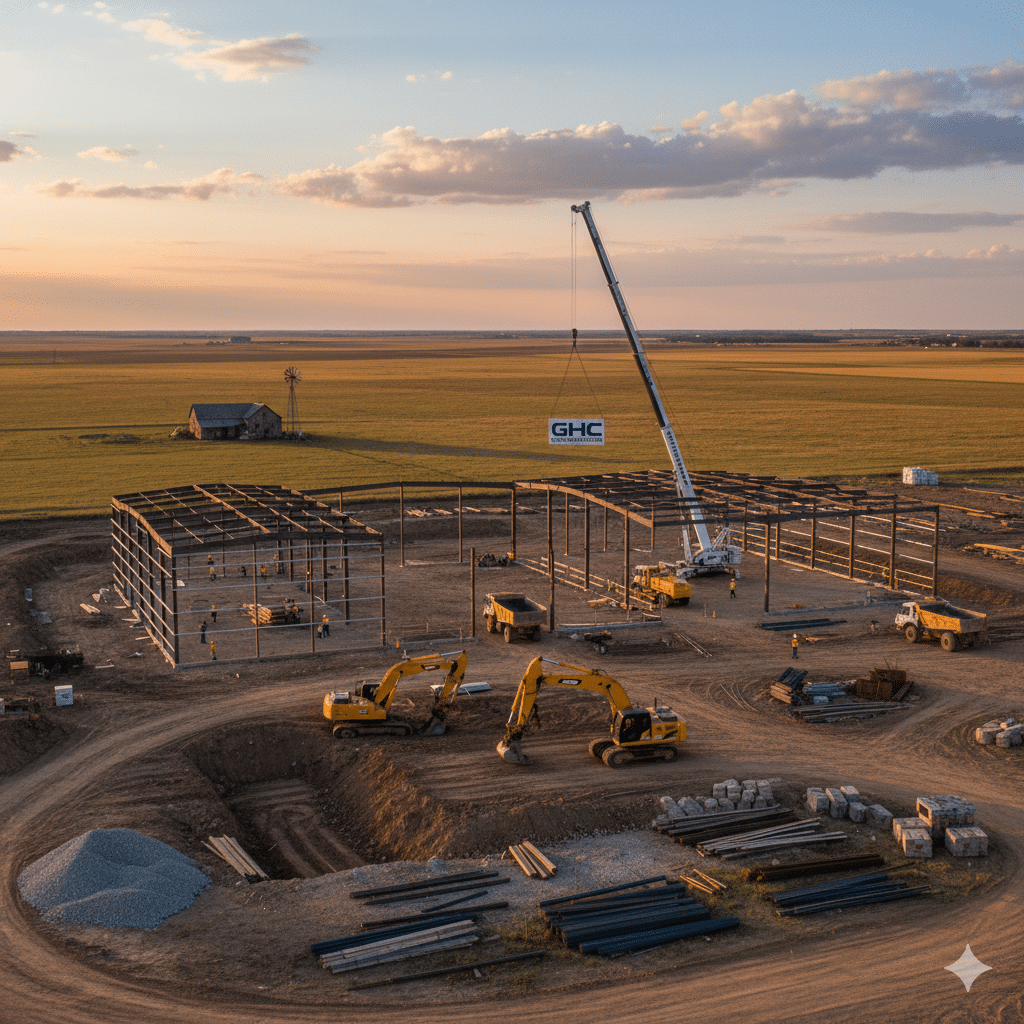

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

- Lima One Capital — Offers competitive fix & flip and new construction loans statewide. Fast approvals for 1-4 unit, major metros and smaller cities.

- Kennedy Funding — Specializes in hard money bridge loans for unique property types and challenging credit scenarios.

- Kiavi (fka LendingHome) — Popular with Colorado investors for seamless online applications and strong support for flips and short-term rentals.

- RCN Capital — Broad suite of DSCR and rehab loan products for rental investors, serving all of Colorado from Denver to Boulder to Pueblo.

- Pine Financial Group — Colorado-based, known for investor-focused fix & flip/rehab loans with rapid funding and local expertise.

Typical 2025 Loan Terms for Colorado 1-4 Unit Fix & Flip / Construction Loans

| Loan Type | Loan Amount | LTV/ARV | Rates | Term | Closing Time |

|---|---|---|---|---|---|

| Fix & Flip Loan | $75K – $500K+ | Up to 85% purchase Up to 100% rehab 70% ARV max |

8.25% – 11.99% | 12-18 months | 7-14 days |

| Construction Loan | $100K – $1.5M | 75% LTC 67% ARV on average |

9% – 12% | 12-18 months | 10-21 days |

| Hard Money Loan | $75K – $900K | Up to 75% LTV | 10% – 13.5% | 6-18 months | 5-10 days |

| DSCR Rental Loan | $100K – $2M | Up to 80% LTV | 6.75% – 9.5% | 30-year | 18-30 days |

Step-by-Step: How to Get Approved for a Fix & Flip or Construction Loan in Colorado (2025)

- Identify the Property

Find a 1-4 unit opportunity and analyze comparable sales, rehab scope, and post-renovation value (ARV). Use local agent input from cities above. - Prepare Detailed Project Budget

Document expected acquisition, hard and soft renovation costs, and timeline using contractor estimates. - Choose a Lender & Apply

Contact lenders (like Pine Financial or Kiavi) and submit an initial application. Online portals often allow document uploads. - Submit Required Documentation

- Purchase contract or proof of ownership

- Scope of work (SOW), contractor bids

- Personal ID, LLC docs if entity-owned

- Recent bank statements (proof of reserves)

- Experience summary (prior flips/rentals a plus!)

- Appraisal and Underwriting

The lender orders an appraisal and reviews the borrower, property, budget, and after-repair value projections. - Loan Approval & Closing

Sign documents, fund earnest deposit, handle closing via title company. Lender funds purchase + escrow for renovations. - Construction & Rehab Draws

Renovation funds are released in stages following inspections and progress reports. - Exit Strategy

Sell for profit (“flip”) or refinance into a DSCR rental loan for long-term holds and cash flow.

Success Stories: Fix & Flip and Construction Loans in Colorado

- Denver’s Park Hill | Single Family Flip

Investor secured a 5K fix & flip loan through Kiavi to acquire and fully rehab a 2-bedroom bungalow. Total rehab budget: $75K. Sold for $425K after 8 months, netting $47K in profit. Fast draw process kept project on schedule. - Aurora’s Del Mar Parkway | Fourplex Turnaround

Client used a 0K construction loan from Pine Financial Group to gut and rebuild a distressed fourplex. All four units leased within 3 months at above-market rents, then refinanced into a DSCR loan at 7.1% fixed. - Fort Collins Midtown | Duplex BRRRR

Investor tapped an $185K rehab loan from RCN Capital for cosmetic upgrades. Appraised for $275K post-renovation, refinanced into 30-year rental loan, monthly cash flow of $420/unit. - Pueblo Belmont | Hard Money Play

Short-term hard money loan ($105K) funded acquisition and light rehab of a triplex at 12%. Quick 90-day turnaround yielded $21K profit on resale.

2025 Colorado Fix & Flip / Construction Loan FAQs

- How fast can I get financing for a rental property renovation?

- With complete paperwork, many Colorado lenders close in 7-14 days for fix & flip or hard money loans. Construction loans may take 2-3 weeks due to draws and permits.

- Is experience required for approval?

- Most lenders welcome first-time investors, but rates and LTVs improve with a proven track record. Many offer coaching to newcomers.

- What types of properties are eligible?

- Single-family homes, duplexes, triplexes, and fourplexes up to 4 units are covered. Condos often qualify if non-warrantable restrictions aren’t present.

- What is ARV, and why does it matter?

- ARV (After Repair Value) is the projected value post-renovation. Loan amounts are a percentage of ARV, protecting investors/lenders if market values shift.

- Can I refinance into a rental loan after a flip?

- Yes, this is commonly known as the BRRRR strategy. Colorado lenders like Lima One and RCN Capital offer DSCR rental loans with cash-out options for long-term holds.

Takeaways: Succeeding with Fix & Flip / Construction Loans in Colorado (2025)

- Leverage short-term rehab and construction financing to modernize 1-4 unit rentals in Colorado’s hottest markets.

- Partner with specialized lenders for fast approvals, higher leverage, and investor-friendly processes.

- Maximize returns by targeting high-demand rental areas like Denver, Colorado Springs, Aurora, and Fort Collins.

- Combine creative strategies—fix & flip, BRRRR, and ground-up builds—to scale your rental portfolio in 2025.

Ready to build your wealth with fix and flip construction loans in Colorado? Connect with local lenders and start your application today for a profitable 2025 investment journey!

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources