Commercial Real Estate Loans in Colorado: The 2025 Investor’s Guide

Colorado’s commercial real estate market continues to flourish in 2025, driven by population growth, technology sector expansion, and steady in-migration. Whether you’re an investor eyeing Denver’s urban office towers or an entrepreneur seeking to develop multifamily units in Colorado Springs, understanding your financing options is critical. This comprehensive guide explores commercial mortgage loans in Colorado, highlights local trends, reviews top lenders, and details the step-by-step application process—empowering you to make smart, profitable investment decisions this year.

- Commercial Real Estate Loans in Colorado: The 2025 Investor’s Guide

- 2025 Colorado Commercial Real Estate Market Overview

- Commercial Mortgage Loans: Investor Essentials

- Key Commercial Lenders in Colorado (2025)

- Step-by-Step: How to Apply for a Colorado Commercial Mortgage

- 2025 Success Stories: Colorado Commercial Mortgage Loans in Action

- Why Choose Commercial Mortgages in Colorado in 2025?

- Conclusion: Next Steps for CRE Investors in Colorado

2025 Colorado Commercial Real Estate Market Overview

Colorado is now considered a top-tier state for diverse CRE investments, offering robust opportunities across sectors:

- Denver Tech Center (DTC): Class A+ business parks and office campuses draw tech firms and medical HQs.

- Downtown Boulder: Vibrant mixed-use projects and retail corridors pair with eco-conscious multifamily buildings.

- Colorado Springs CBD: Ongoing revitalization with new hotels, offices, and adaptive reuse developments.

- Fort Collins Midtown: High demand for student and multifamily housing, with strong rent growth projections for 2025.

- Aurora Southeast Corridor: Industrial parks and logistics/distribution centers benefit from proximity to major highways.

- Golden: Niche opportunities in hospitality and tourism real estate, serving outdoor and adventure markets.

- Loveland/Greeley: Expanding light industrial areas cater to manufacturing and agricultural investors.

Local Insight: The Colorado commercial loan market has seen improved liquidity and more favorable debt coverage ratios as cap rates have stabilized in Q1 2025, particularly for core office and multifamily assets in metro Denver and Boulder.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

Small Business Loans in South Gate, California for 2025 Contact Information: GHC Funding833-572-4327" loading="lazy" srcset="https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f-1024x1024.jpeg 1024w, https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f-300x300.jpeg 300w, https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f-150x150.jpeg 150w, https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f-768x768.jpeg 768w, https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f-1536x1536.jpeg 1536w, https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f.jpeg 2048w" sizes="auto, (max-width: 1024px) 100vw, 1024px" />

Small Business Loans in South Gate, California for 2025 Contact Information: GHC Funding833-572-4327" loading="lazy" srcset="https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f-1024x1024.jpeg 1024w, https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f-300x300.jpeg 300w, https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f-150x150.jpeg 150w, https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f-768x768.jpeg 768w, https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f-1536x1536.jpeg 1536w, https://ghcfunding.com/wp-content/uploads/2024/08/Gemini_Generated_Image_1g4fgs1g4fgs1g4f.jpeg 2048w" sizes="auto, (max-width: 1024px) 100vw, 1024px" />

Commercial Mortgage Loans: Investor Essentials

For most commercial property acquisitions, refinances, or cash-outs in Colorado, a commercial mortgage loan is the backbone of your financing strategy. These loans typically range from $500,000 to $25 million, depending on the property type and strength of the borrower.

What Defines a Colorado Commercial Mortgage in 2025?

- Loan-to-Value (LTV): 65% to 75% for stabilized properties; up to 80% for owner-occupied/low-risk assets.

- Terms: Fixed rates for 5, 7, or 10 years with 20- to 30-year amortizations. Floating rates available for selected properties.

- Permitted Property Types: Office buildings, retail, strip malls, industrial warehouses, hospitality, self-storage, and more.

- Rates: As of Q2 2025, rates range from 6.30% to 7.50% for prime-borrower scenarios.

- Minimum DSCR: 1.25x required on most transactions by leading banks.

Key Commercial Lenders in Colorado (2025)

- FirstBank – Headquartered in Lakewood, offers portfolio loans for stabilized office and retail.

- U.S. Bank – Strong presence in Denver metro, provides permanent financing and SBA 504 for owner-users.

- MidFirst Bank – Well-known for competitive rates on industrial and multifamily projects statewide.

- Sunflower Bank – Focus on value-add properties and flexible prepayment structures.

- Rocky Mountain Bank & Trust – Local lender with expertise in hospitality and agricultural CRE loans.

- KeyBank Real Estate Capital – Active in non-recourse debt for large Denver and Boulder multifamily assets.

Step-by-Step: How to Apply for a Colorado Commercial Mortgage

- Analyze Your Project

Define property type, purchase price or project cost, NOI, and intended use. - Select the Right Lender

Factor in property location, loan size, and preferred structure. Contact 2-4 banks or brokers for quotes. - Prepare Your Application Package

- Borrower financial statements & credit score (min 660-680 FICO preferred by most banks)

- Three years business tax returns

- Rent roll and operating statements (if applicable)

- Property appraisal and environmental assessment (most lenders require Phase I ESA)

- Detailed business plan (for value-add or owner-occupied scenarios)

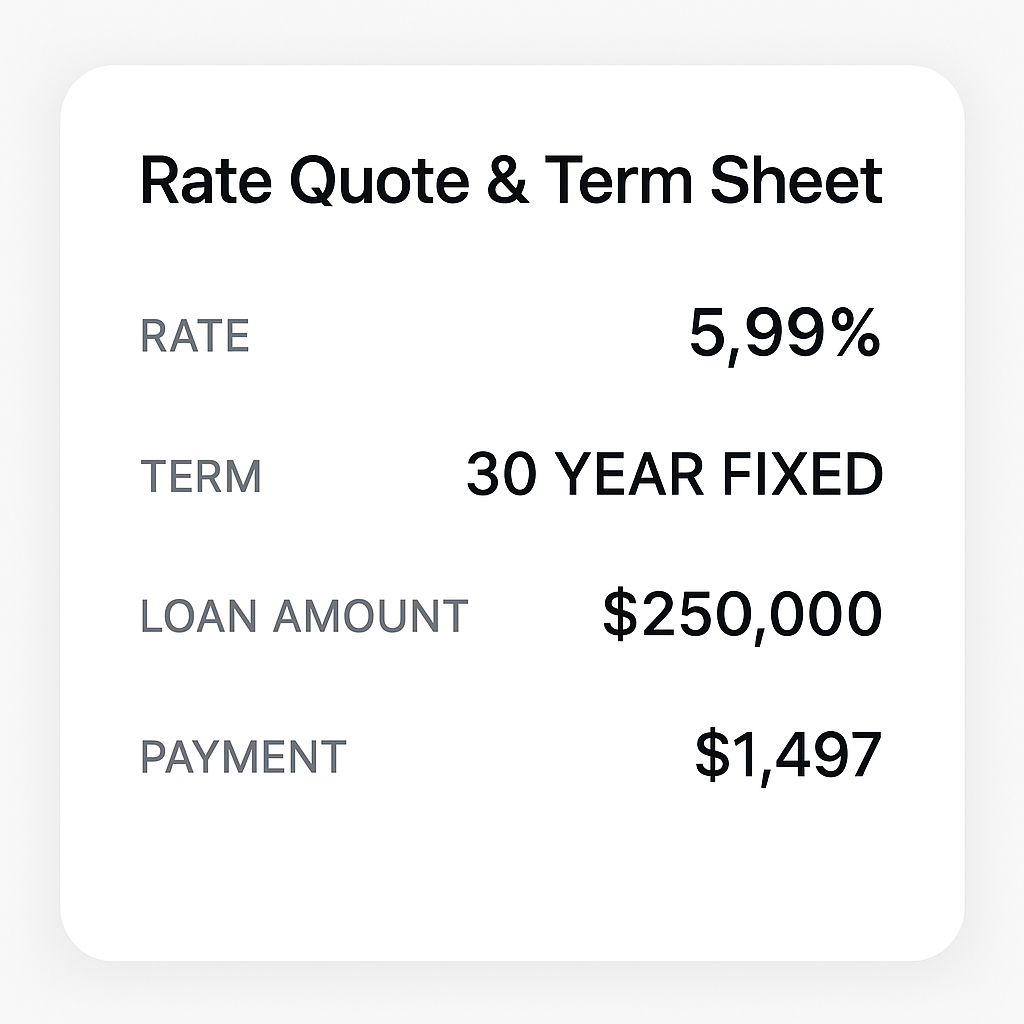

- Submit Application & Receive Term Sheet

Lender reviews file and issues conditional Letter of Intent (LOI) or Term Sheet outlining rates, terms, and conditions. - Order Third-Party Reports

Appraisal, environmental studies, and property condition assessment are coordinated by lender or via approved vendors. - Final Underwriting & Approval

Full credit and collateral review by lender’s CRE team and loan committee. - Closing

Legal documentation, title work, funding of loan proceeds. Typically 40-60 days from application to closing for standard purchases/refinances.

Tip: Work with a Colorado-based commercial mortgage broker to expedite and negotiate competitive terms, especially in competitive submarkets like Denver Tech Center and Boulder.

2025 Success Stories: Colorado Commercial Mortgage Loans in Action

- Boulder Mixed-Use Refinance: An investor refinanced a $3.25M boutique office/retail building at 70% LTV. U.S. Bank provided a 7-year fixed, 6.60% rate with 25-year amortization, allowing the borrower to cash-out $500,000 to fund new acquisitions.

- Denver Industrial Acquisition: Local developer acquired a $2.1M flex industrial property near I-70, securing a 10-year, 7.35% commercial mortgage from Sunflower Bank with a 1-year interest-only period and non-recourse structure.

- Colorado Springs Multifamily Purchase: Entrepreneurial group purchased a $5.2M, 28-unit apartment building using KeyBank Real Estate Capital’s 10-year fixed-rate loan at 6.80% and 30-year amortization, utilizing pro-forma rents and value-add projections.

- Loveland Owner-Occupant Office: Medical practice bought its own $900K office condo, securing 80% LTV financing via SBA 504 program through FirstBank—offering a blended 6.50% rate and just 15% down.

Why Choose Commercial Mortgages in Colorado in 2025?

- More flexible DSCR/LTV structures for experienced sponsors and owner-users

- Strong rent growth in tech and lifestyle corridors attracts lenders’ interest

- Tax advantages for property ownership vs. leasing, especially with favorable Colorado depreciation rules

- Broad selection of local, regional, and national lenders with deep knowledge of Colorado’s submarkets

Colorado’s commercial mortgage market in 2025 remains one of the most borrower-friendly in the Mountain West, combining competitive rates with a proven, transparent underwriting process. Investors equipped with local knowledge and a strong lending relationship can leverage significant upside in the state’s fast-growing CRE sectors.

Conclusion: Next Steps for CRE Investors in Colorado

If you’re ready to acquire or refinance a commercial property in Colorado, start by analyzing your project, assembling required documentation, and reaching out to multiple lenders—including those with deep statewide footprints. With above-average liquidity, tailored loan products, and expert professionals available year-round, the Colorado commercial real estate loan market is primed to help you unlock value and scale your portfolio in 2025.

Disclaimer: The rates and terms discussed reflect market conditions as of early 2025 and may change based on lender programs and federal monetary policy. Always consult with a qualified commercial real estate finance advisor before committing to any loan product.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources