Inflation Budgeting & Best Real Estate Investments During High Inflation (2025 Guide)

With persistent inflation projected to impact the global economy through 2025, effective budgeting and strategic real estate investing are indispensable tools for individuals and investors determined to protect and grow their wealth. This comprehensive guide explores actionable approaches to inflation budgeting, methods to identify superior real estate investments, and proven strategies for portfolio diversification and robust economic planning.

- Inflation Budgeting & Best Real Estate Investments During High Inflation (2025 Guide)

- 1. Understanding Inflation in the 2025 Economic Context

- 2. Budgeting for Inflation: Practical Strategies

- 3. Real Estate as an Inflation Hedge

- 4. Best Real Estate Investments During High Inflation

- 5. Portfolio Diversification: Strategic Asset Allocation for Inflation Protection

- 6. Economic Planning: Looking Ahead in 2025

- 7. Actionable Takeaways for 2025

- Conclusion

1. Understanding Inflation in the 2025 Economic Context

Economic indicators suggest inflation rates remained elevated in early 2025, with the Consumer Price Index (CPI) hovering between 4.8% and 5.4% annually in many developed nations. Drivers include ongoing supply chain challenges, volatile energy prices, and labor market shifts. These persistent cost increases put continuous strain on household budgets and compel investors to revisit their wealth protection strategies.

2. Budgeting for Inflation: Practical Strategies

The Impact on Everyday Living Costs

- Groceries: Staple foods like grains, dairy, and meats are up 12-15% YoY.

- Utilities: Elevated global energy prices have led to double-digit increases in electricity and gas bills.

- Housing: Rents and home maintenance costs continue to climb, particularly in urban areas.

Step-by-Step Inflation Budgeting Process

- Track and Reassess All Expenses: Use budgeting apps or digital spreadsheets to record monthly outflows. Categorize spending to identify price surges and discretionary opportunities.

- Adjust Essential Spending Targets: Allocate additional funds to high-inflation categories, like groceries (add 10-15% buffer) and utilities (plan 12-18% higher than prior year).

- Boost Your Emergency Fund: Amid uncertainty, reserve at least 6-9 months’ worth of living expenses, accounting for inflated costs.

- Cut Non-Essential Spending: Postpone big purchases, cancel unused subscriptions, and prioritize must-haves over wants.

- Negotiate and Shop Smarter: Switch to cost-efficient brands, bulk-buy non-perishables when sales arise, and leverage loyalty discounts.

- Automate and Monitor: Set up automated savings/investments indexed to inflation and review your budget monthly.

Success Story: Smart Inflation Budgeting in 2025

Lisa, a single parent from Austin, Tex., documented her spending and discovered utility bills had risen 20%. By renegotiating her Internet and insurance bills and meal-prepping from bulk grocery purchases, she trimmed non-essential costs and boosted her emergency fund, weathering inflation without touching her investments.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

3. Real Estate as an Inflation Hedge

Property ownership has consistently proven to be a powerful defense against inflation. As currency’s purchasing power declines, real assets like real estate generally appreciate, preserving wealth and facilitating steady income generation. In 2025, as inflation continues to shape economic dynamics, strategic real estate investments can help diversify portfolios and mitigate risks.

Why Real Estate Protects Against Inflation

- Property Values Rise: As construction and material costs increase, so do property prices.

- Rental Income Adjusts: Leases often reset annually, allowing landlords to incrementally raise rents alongside inflation.

- Mortgage Repayments Benefit: Fixed-rate mortgage payments become cheaper in real terms as inflation erodes debt value over time.

- Tangible Asset Security: Real estate remains a hard asset with persistent demand, even amid currency fluctuations.

Case Study: Multi-Family Rentals in 2025

During 2022-2025, Chicago’s multi-family rental market thrived. As housing demand and inflation surged, median rents grew by 9% annually while fixed-mortgage landlords’ real payments fell, demonstrating predictable cash flow and asset appreciation.

4. Best Real Estate Investments During High Inflation

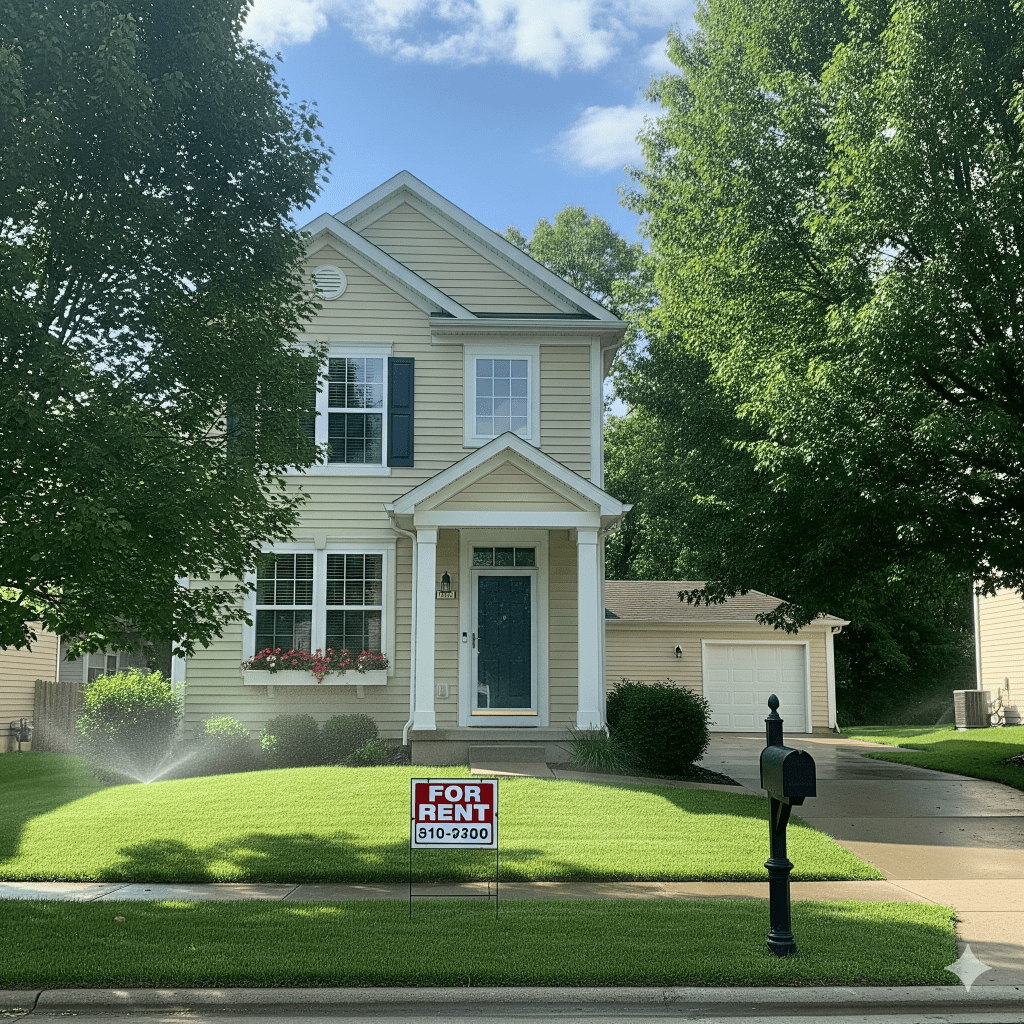

1. Residential Rental Properties

- Description: Single-family and multi-family units leased on yearly or short-term bases.

- Inflation Benefit: Ability to adjust rents regularly maintains parity with rising costs.

- Tactical Tip: Focus on markets with population growth, strong employment, and constrained housing supply.

2. Real Estate Investment Trusts (REITs)

- Description: Publicly traded or private investment vehicles that pool capital to own, manage, or finance income-producing real estate.

- Inflation Benefit: REITs often increase distributions as rents and property values climb.

- Tactical Tip: Diversify across sectors (e.g., industrial, logistics, multifamily) for risk reduction.

3. Commercial Real Estate (CRE)

- Description: Includes office buildings, warehouses, retail centers, and industrial spaces.

- Inflation Benefit: Commercial leases often feature rent escalations tied to inflation indices.

- Tactical Tip: Explore high-growth tech and supply chain hubs for premium appreciation.

4. Land Investment

- Description: Buying undeveloped land in expectation of future appreciation.

- Inflation Benefit: Land is a finite resource; scarcity pushes up value as development costs rise.

- Tactical Tip: Focus on fast-growing suburban or exurban markets anticipating infrastructure expansion.

Success Story: REIT Diversification Pays Off

Antonio, an investor from Toronto, shifted 30% of his portfolio into diversified REITs in late 2023. By early 2025, his returns outpaced inflation by over 4%, driven by rising property values and consistent dividend growth.

5. Portfolio Diversification: Strategic Asset Allocation for Inflation Protection

Combining real estate exposure with other inflation-hedging assets maximizes resilience. Consider introducing Treasury Inflation-Protected Securities (TIPS), commodity funds, or foreign real estate for further diversification. Regular portfolio reviews, especially during periods of high volatility, are essential for balanced risk and reward.

- Keep 20-35% of your total portfolio in real assets (including REITs and direct property ownership)

- Maintain liquidity via diversified cash equivalents in high-yield savings or money market funds

- Monitor correlation and rebalance semi-annually in response to inflation and economic shifts

Case Study: Balanced Portfolio Resilience

During 2024’s inflation spike, a family office in Berlin shifted 40% of its holdings to a blend of global REITs, inflation-linked bonds, and rental residential property. Their overall investment returns remained 2-3 percentage points above inflation through 2025, even as traditional equity and bond markets faltered.

6. Economic Planning: Looking Ahead in 2025

To stay competitive, investors and households must proactively refine their economic plans. Consider these strategies as you budget and invest amid inflation:

- Regularly Review and Adjust: Continue to reassess your financial plan and investment performance at least quarterly as new economic data emerges.

- Pursue Education: Stay current on inflation trends and property market shifts through reputable finance publications and expert advisory services.

- Embrace Flexibility: Be prepared to adapt quickly—whether reallocating funds or pursuing new property acquisitions—as inflation scenarios evolve.

7. Actionable Takeaways for 2025

- Prioritize inflation budgeting: Monitor expenses, expand cash reserves, and plan for higher living costs.

- Invest in real assets: Use real estate to protect and grow wealth, focusing on residential rentals, commercial properties, REITs, and strategic land acquisitions.

- Diversify your portfolio: Balance direct real estate with inflation-protected securities and other hedges.

- Be proactive and vigilant: Regular economic planning, expense audits, and market research will keep you ahead of inflation’s impact.

Conclusion

The era of high inflation challenges both savers and investors, but also opens opportunities for strategic action. By carefully budgeting for inflation and allocating capital to the right real estate assets, you can fortify your financial position and achieve resilient, long-term gains in 2025 and beyond. Remember: success is less about predicting the future, and more about preparing purposefully in the present.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources