Fix and Flip Construction Loans in Wisconsin: Your 2025 Definitive Guide for 1-4 Unit Rentals

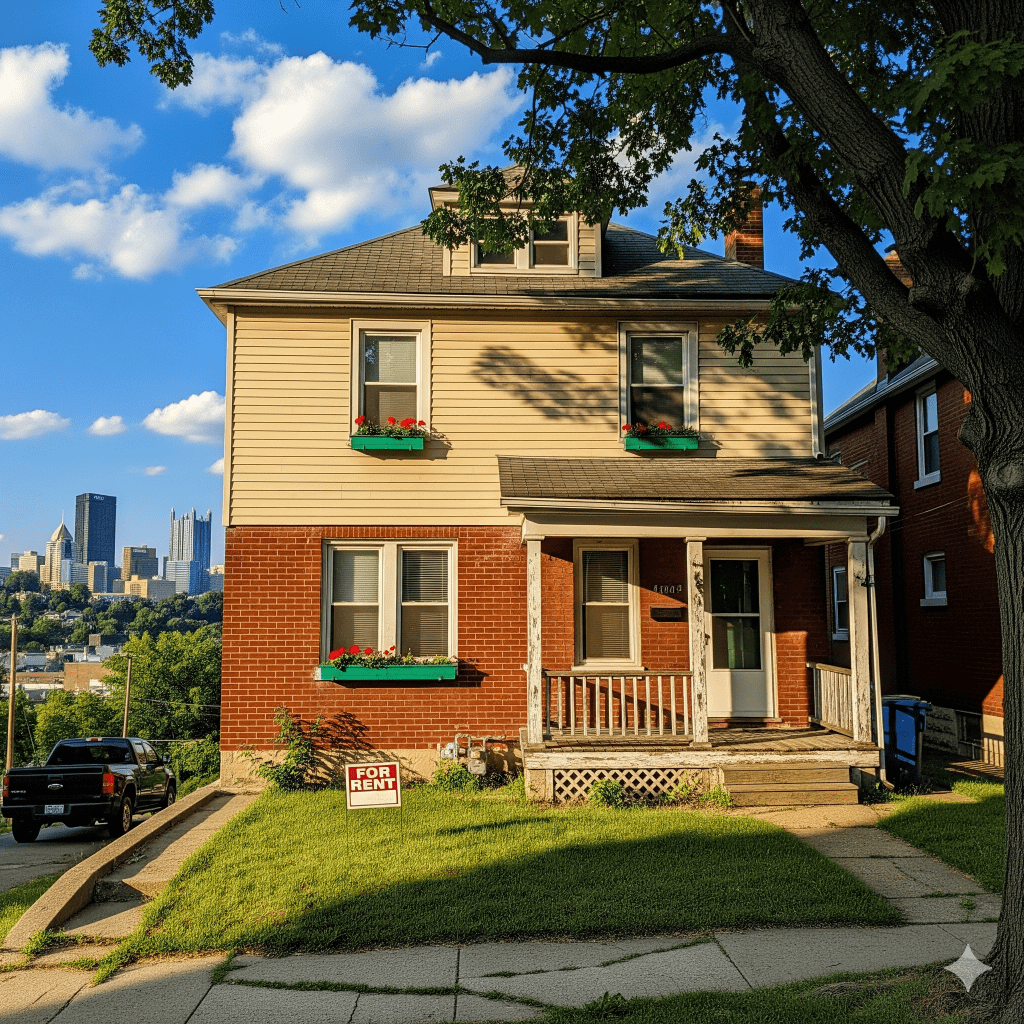

Investing in 1-4 unit rental properties in Wisconsin remains a profitable strategy in 2025, fueled by resilient Midwest demand and attractive property values. Whether you’re renovating a Milwaukee duplex, building a new triplex in Madison, or upgrading a fourplex in Green Bay, the right financing is crucial. In this guide, we’ll unpack Wisconsin-specific market trends, lender options, loan types (fix & flip, construction, hard money, and DSCR loans), and streamlined strategies for successful 1-4 unit investments.

- Fix and Flip Construction Loans in Wisconsin: Your 2025 Definitive Guide for 1-4 Unit Rentals

- Wisconsin’s Hottest 1-4 Unit Investment Areas for 2025

- Key Loan Options for Wisconsin 1-4 Unit Investments in 2025

- Top Wisconsin Lenders Specializing in 1-4 Unit Rehab and Construction

- Wisconsin Market Intelligence (2025 Snapshot)

- How to Secure Your Fix & Flip or Construction Loan in Wisconsin

- Real Wisconsin Fix & Flip & Construction Loan Success Stories

- Wisconsin Fix & Flip and Construction Loan FAQs

- 2025 Trends: Maximizing Returns with Wisconsin’s Top Lenders

- Get Started: Your 2025 Wisconsin Rental Investment Journey

Wisconsin’s Hottest 1-4 Unit Investment Areas for 2025

- Milwaukee’s Bay View & Riverwest: Known for their character homes and strong rental demand—prime for duplex and triplex renovations.

- Madison’s Isthmus & East Side: Growing student and young professional base create high demand for renovated single-families and multis.

- Green Bay’s Astor Park: Affordable 4-unit properties near downtown offer excellent cash flow post-renovation.

- Appleton’s Historic Downtown: Transitioning neighborhoods with value-add potential for single-family flips and rehabs.

- Kenosha Uptown: Noted for older housing stock ready for cosmetic and structural updates at accessible entry prices.

- Eau Claire’s North Side: University proximity supports stable rental demand, especially for updated small multis.

- Wauwatosa: Suburban feel, but walkable amenities make it appealing to renters and families alike.

Key Loan Options for Wisconsin 1-4 Unit Investments in 2025

1. Fix & Flip Loans

- Designed for short-term (6-18 months) purchase and renovation projects.

- Funds cover acquisition + rehab (often up to 85% LTC and 100% of rehab budget).

- Typical rates in Wisconsin for 2025: 8.50%-11.99% interest-only with 1-3% origination fees.

- Best for quick renovations and sales or transitions to long-term rental financing after the rehab.

2. Construction Loans

- Used for ground-up builds or major remodels.

- Usually interest-only during construction, converting to permanent (“construction-to-perm”) financing.

- Loan size: $75,000-$1,500,000+ for single-family to fourplex projects.

- Disbursement via draws as work progresses; detailed budgets and inspections required.

3. Hard Money Loans

- Fast, asset-based lending for investors who don’t qualify for bank loans or require speed.

- More flexible underwriting—credit, income, and documentation are less critical.

- 2025 Wisconsin rates: usually 10-13% interest-only, 6-24 month terms common.

- Ideal for time-sensitive flips or value-add multis in competitive neighborhoods.

4. DSCR Rental Loans

- Long-term, fixed-rate or adjustable mortgages underwritten to the property’s Debt Service Coverage Ratio (DSCR), not personal income.

- Common for refinancing post-rehab or holding rental properties after a fix & flip exit.

- 30-year terms available, with minimum DSCR typically 1.10-1.25.

- 2025 rates in Wisconsin: 6.50-8.25% (varies by leverage and DSCR).

Top Wisconsin Lenders Specializing in 1-4 Unit Rehab and Construction

| Lender | Loan Types | WI Coverage | Typical Terms |

|---|---|---|---|

| RCN Capital | Fix & Flip, DSCR, Bridge | Statewide | 75-85% LTC, 6-30 mo, $75K-$2M |

| Lima One Capital | Construction, Fix & Flip, Rentals | Statewide | Up to 90% rehab, 70-80% ARV |

| Wisconsin Mortgage Corporation | Construction-to-Perm | Statewide, Local Expertise | $100K-$1M, flexible draws |

| Kiavi (formerly LendingHome) | Fix & Flip, DSCR | Statewide | $100K+, streamlined approvals |

| Direct Mortgage Investments | Hard Money, Construction | Milwaukee, Madison, Fox Valley | 12-24 mo, up to 70% ARV |

| Temple View Capital | DSCR, Fix & Flip, Rental Portfolio | Statewide | Up to 80% LTV, 30-year options |

Wisconsin Market Intelligence (2025 Snapshot)

- Median single-family price (statewide): $311,500

- 1-4 unit rent growth: 4.1% YoY in Milwaukee, 3.8% in Madison

- Renovated 1-4 unit cap rates: 6.2% (state average, higher in tertiary markets)

- Investor volume: Up 7% due to Midwest in-migration and steady rental demand

- Permit activity: Small multifamily construction rising in Dane, Brown, and Milwaukee counties

- Typical rehab budgets: $35K (cosmetic single family) to $180K+ (heavy value-add fourplex)

How to Secure Your Fix & Flip or Construction Loan in Wisconsin

- Find and Evaluate Your 1-4 Unit Property

Analyze comparable sales, estimated ARV, required rehab scope, and rental comps. Neighborhood choice (like Bay View or Astor Park) will impact both rent potential and exit strategy. - Connect with Local/Regional Lenders

Get pre-qualified from 2-4 lenders such as RCN Capital or Wisconsin Mortgage Corp. Discuss terms, pricing, max leverage, and prepayment penalties. - Gather Documentation

Typically includes recent tax returns (if needed), bank statements, contractor bids, budget breakdowns, purchase contract, and your rehab/construction experience résumé. Hard money lenders may only require minimal documentation. - Order Appraisal & Underwriting

Lender arranges an appraisal and reviews scope-of-work or draws schedule. Quick close (7-14 days) possible with complete packages. - Close & Start Project

Funding is provided at close (often with “draws” available for rehab/construction milestones). Schedule regular inspections to keep funds flowing on construction loans. - Exit/Reposition

Sell completed 1-4 unit (flip), or refinance into a DSCR long-term loan for rental cash flow. For example, leverage Temple View Capital for cash-out DSCR financing.

Real Wisconsin Fix & Flip & Construction Loan Success Stories

- Madison Duplex Conversion: Purchased off-market for $215,000, $105,000 in renovations financed via hard money (11% interest, 12 months, 2 points from Lima One Capital). ARV at $425,000. Rented for $2,700/month, then refinanced into a 30-year DSCR loan at 7.15%.

- Milwaukee Bay View Fourplex Gut Rehab: Bought for $420,000, with $180,000 rehab (RCN Capital, 85% LTC, 12 month term at 9.9%). Post-rehab valuation: $725,000 with projected rent roll of $6,100/month.

- Green Bay Single-Family Flip: Acquired for $119,000, $55,000 cosmetic renovation funded by Direct Mortgage Investments hard money (12%, 6-month term), sold post-upgrade for $225,000.

- Appleton New Fourplex Construction: Construction loan from Wisconsin Mortgage Corp ($520,000, 12 months, 7.25% interest-only), with permanent DSCR take-out; stabilized rents support $3,850/month net operating income.

Wisconsin Fix & Flip and Construction Loan FAQs

- What credit score do I need for Wisconsin fix & flip or construction loans?

- Most lenders require 660+ for premier rates. Some hard money options go as low as 600. DSCR rental loans typically require 680+.

- How much can I borrow?

- Loan amounts range from ,000 to ,000,000+ for 1-4 unit properties, depending on project, experience, and area.

- How quickly can I access funds?

- Asset-based/hard money lenders can close in 7-14 days, while ground-up construction or bank-funded deals take 21-45 days on average.

- What are typical down payment or equity requirements?

- Most fix & flip and construction lenders require 10-25% down, with additional reserves for hard money or larger projects. DSCR loans usually allow up to 80% LTV on stabilized rentals.

2025 Trends: Maximizing Returns with Wisconsin’s Top Lenders

- Investor Demand is Outpacing Inventory, especially for rehabbed properties in walkable, high-growth submarkets.

- Construction-to-Perm Loans are attractive for those looking to build, stabilize, and refi into DSCR long-term products without multiple closings.

- Lender competition in Wisconsin is driving better rates and lower origination fees for experienced investors in 2025.

Get Started: Your 2025 Wisconsin Rental Investment Journey

Leveraging fix & flip, construction, or DSCR loans is key to unlocking profits in Wisconsin’s robust 1-4 unit property market. As local neighborhoods continue to evolve, finding the right lender and financing product can help you scale your portfolio, generate consistent rental income, and maximize your investment returns in 2025 and beyond.

Contact an experienced Wisconsin real estate lender to discuss your project and get pre-qualified for the right 1-4 unit loan today!

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources