Contributing Author & Editorial Review

This article was authored and professionally reviewed to provide accurate, actionable financial insights.

GHC Funding

Contributing Author

Alyssa writes about real estate investing, debt-free strategies, and emerging trends in small business finance with a focus on practical insights.

Samantha Reyes

Senior Content Editor

Samantha specializes in editorial strategy, compliance review, and refining complex finance topics into accessible, reader-friendly guidance.

DSCR Rental Loan Highlights

- Qualification based mainly on property cash flow (DSCR).

- No personal income docs required for many programs.

- Financing for 1–8 unit rentals, portfolios, and many STR/Airbnb deals.

- Up to 80% LTV on purchases and 75% LTV on cash-out (program-dependent).

- 30-year fixed and interest-only options available.

Top DSCR Lenders for Real Estate Investors in Kansas

Meet John, a real estate investor from Wichita, Kansas. With a few residential properties under his belt, John was ready to expand into commercial real estate. However, he faced challenges securing the right financing. Like many Kansas investors, John needed a lender who understood his unique situation and could provide a loan tailored to his needs. This is where understanding the best DSCR lenders becomes crucial.

What is DSCR and Why Does It Matter?

The Debt Service Coverage Ratio (DSCR) is a key metric used by lenders to determine a borrower’s ability to repay a loan. It compares a property’s annual net operating income to its annual debt obligations. A higher DSCR indicates a stronger ability to cover debt, making it an essential factor for real estate investors.

For real estate investors in Kansas, having a strong DSCR can mean the difference between securing a loan or facing rejection. Understanding which lenders offer the best terms can significantly impact your investment strategy.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

- DSCR is crucial for assessing financial health.

- A strong DSCR can lead to better loan terms.

Best DSCR Lenders in Kansas

Choosing the right lender in Kansas means finding one that offers competitive rates and understands local market conditions. Here are some key players:

- Bank of Kansas City: Known for its flexible terms and fast approvals.

- Sunflower Bank: Offers tailored solutions for real estate investors.

- GHC Funding: Specializes in DSCR loans, providing personalized service to meet investor needs.

These lenders are familiar with Kansas’s unique real estate market, making them ideal partners for local investors.

Understanding the Kansas Market

Kansas offers diverse opportunities for real estate investors, from bustling urban centers like Kansas City to growing areas like Overland Park. However, each area presents unique challenges, such as varying property values and tenant demand.

Investors must navigate these market conditions carefully, choosing lenders who understand the local landscape.

Key Considerations for Kansas Investors

Before choosing a DSCR lender, Kansas investors should be aware of the following:

- Credit Score Requirements: Most lenders require a minimum score of 680.

- Approval Time: Typically ranges from 2 to 4 weeks.

- Common Mistakes: Overestimating property income, underestimating expenses, ignoring local market trends, and failing to prepare necessary documentation.

By understanding these factors, investors can position themselves for success.

Real Case Study: Success in Wichita

Consider Sarah, a real estate investor in Wichita. She partnered with GHC Funding to secure a DSCR loan for a commercial property. With a DSCR of 1.25 and a credit score of 700, Sarah successfully expanded her portfolio, increasing her annual revenue by 30%.

This success story highlights the importance of choosing the right lender and understanding your financial metrics.

Frequently Asked Questions

- What is the minimum DSCR required? Most lenders look for a DSCR of at least 1.20.

- How does DSCR affect loan terms? A higher DSCR can lead to lower interest rates and better terms.

- Can I improve my DSCR? Yes, by increasing property income or reducing expenses.

- Are there fees associated with DSCR loans? Yes, typical fees include origination and appraisal fees.

- What documents are needed for a DSCR loan? You’ll need financial statements, tax returns, and a detailed business plan.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

SBA loan rates 2026 in Arkansas Now

GHC Funding Website Published: February 10, 2026 Categories: blog Reading Time: 3 minutes read Understanding SBA Loan Rates in 2026: A Guide…

Read more →

Best DSCR Lenders for Real Estate Investors in Arkansas

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Real Estate Opportunities: Best DSCR Lenders for…

Read more →

Construction Loan Interest Rates Today in Arkansas Now

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 4 minutes read Understanding Construction Loan Interest Rates in Arkansas: A…

Read more →

SBA 7(a) vs 504 Loan Differences in Arkansas Now

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 4 minutes read SBA 7(a) vs 504 Loans: Choosing the Right…

Read more →

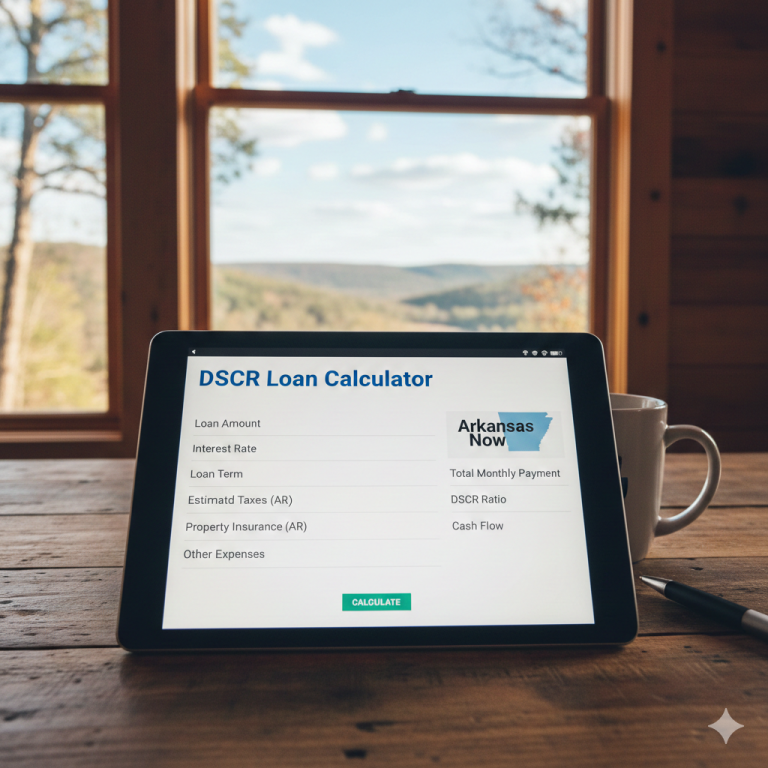

DSCR Loan Calculator with Taxes in Arkansas Now

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Financial Opportunities: Understanding the DSCR Loan Calculator…

Read more →

How to Get a Construction to Permanent Loan in Arkansas

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 4 minutes read Unlocking Opportunities: How to Get a Construction to…

Read more →Take the Next Step with GHC Funding

If you’re a real estate investor in Kansas, finding the right DSCR lender can transform your investment strategy. Contact GHC Funding today to explore personalized loan options that align with your goals. Our team is here to guide you through the process, ensuring you have the support needed to succeed.

“`

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources