Contributing Author & Editorial Review

This article was crafted and reviewed by experienced professionals to ensure accuracy and practical insight.

DSCR Rental Loan Highlights

- Qualification based mainly on property cash flow (DSCR).

- No personal income docs required for many programs.

- Financing for 1–8 unit rentals, portfolios, and many STR/Airbnb deals.

- Up to 80% LTV on purchases and 75% LTV on cash-out (program-dependent).

- 30-year fixed and interest-only options available.

Finding the Best DSCR Lenders for Real Estate Investors in Nebraska

John, a seasoned real estate investor from Omaha, faced a familiar predicament. Despite having a robust portfolio, he struggled to secure traditional financing for his next project. The banks required extensive documentation and the process was painfully slow. That’s when John discovered the power of DSCR loans, tailored for investors like him. His experience sheds light on a crucial financing solution many Nebraska investors are still unaware of.

Understanding DSCR Loans

Debt Service Coverage Ratio (DSCR) loans are designed specifically for real estate investors. Unlike traditional loans that focus heavily on personal income, DSCR loans consider the property’s income potential. This is a game-changer for investors with multiple properties or unconventional income streams. In Nebraska, where the real estate market is competitive yet promising, DSCR loans offer a strategic advantage.

- Minimal personal income verification

- Based on property cash flow

In cities like Lincoln and Omaha, where property values are steadily increasing, DSCR loans provide the flexibility investors need to seize opportunities quickly.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

The Best DSCR Lenders in Nebraska

Choosing the right lender is crucial. Here are some of the best DSCR lenders catering to Nebraska investors:

- Bank A: Known for their quick approval process, typically within 14 days.

- Lender B: Offers competitive interest rates and flexible terms.

- Financing Group C: Specializes in investment properties in Nebraska’s urban areas.

Navigating the local real estate market’s nuances requires lenders who understand Nebraska’s unique challenges and opportunities.

Key Requirements and Considerations

To qualify for a DSCR loan in Nebraska, investors typically need a credit score of at least 680. However, some lenders might accept lower scores with compensating factors. Approval usually takes between 10 to 21 days, depending on the lender and complexity of the deal.

Common mistakes Nebraska investors make include:

- Underestimating property expenses

- Overvaluing projected rental income

- Ignoring local market trends

- Failing to prepare proper documentation

Being aware of these pitfalls can save time and money.

Case Study: Success in Omaha

Consider Sarah, an investor from Omaha, who utilized a DSCR loan to purchase a duplex. With a property cash flow of ,500 monthly and a loan amount of 0,000, she secured financing in just 15 days. Her success story highlights the effectiveness of DSCR loans for Nebraska investors.

Frequently Asked Questions

Here are some common questions Nebraska business owners ask about DSCR loans:

- What is a DSCR loan? A loan based on property income rather than personal income.

- How is DSCR calculated? By dividing net operating income by total debt service.

- Are DSCR loans only for commercial properties? No, they can be used for residential investments too.

- What happens if my property’s income decreases? Lenders will assess risk but may offer flexible terms.

- Can I refinance with a DSCR loan? Yes, many investors use DSCR loans for refinancing.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

Get The SBA Express Loan Application in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Simplifying the SBA Express Loan Application Process in…

Read more →

Get SBA 7(a) or 504 loan in New York Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read SBA 7(a) vs 504 Loans: Navigating Business Financing…

Read more →

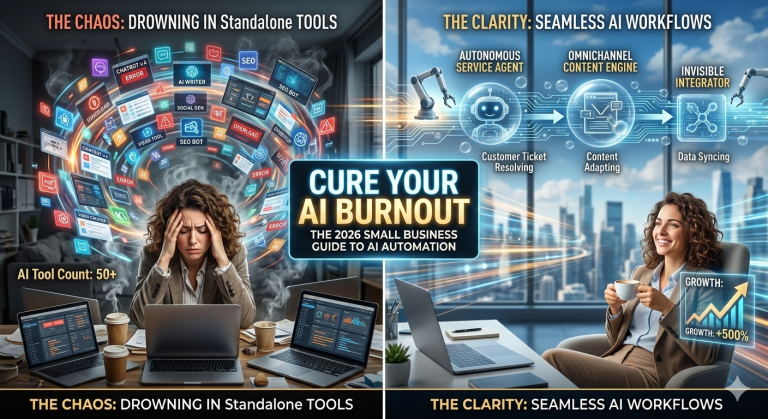

2026 Guide to AI for Small Business: Tools & Scaling Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 6 minutes read The 2026 Guide to…

Read more →

DSCR Loan Calculator with Taxes in New York Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Business Potential: Understanding…

Read more →

The Entrepreneurial Finance in 2026: Liquidity & AI Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 4 minutes read The New Rules of…

Read more →

Get The Entrepreneurial Finance Trends 2026 Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 8 minutes read Entrepreneurial Finance Trends 2026:…

Read more →Contact GHC Funding Today

Are you ready to leverage DSCR loans for your real estate investments in Nebraska? Contact GHC Funding today to explore your options. Our team of experts is here to guide you through the process, ensuring you make the most of your investment opportunities.

“`

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources