Contributing Author & Editorial Review

This article was authored and professionally reviewed to provide accurate, actionable financial insights.

GHC Funding

Contributing Author

Alyssa writes about real estate investing, debt-free strategies, and emerging trends in small business finance with a focus on practical insights.

Samantha Reyes

Senior Content Editor

Samantha specializes in editorial strategy, compliance review, and refining complex finance topics into accessible, reader-friendly guidance.

SBA 7(a) & 504 Highlights

- Loan amounts from $100,000 up to $15 million+ (program-dependent).

- Up to 90% financing for eligible acquisitions, real estate, and equipment.

- Use funds for working capital, refinance, expansion, and partner buyout.

- Longer terms (up to 25 years on real estate) to keep payments manageable.

Understanding SBA Loan Rates in 2026: A Guide for North Carolina Business Owners

In the heart of Raleigh, a small business owner named Sarah faced a dilemma. Her thriving bakery needed expansion to meet growing demand, but traditional loans seemed daunting. Like many North Carolina entrepreneurs, she turned to SBA loans, a lifeline for small businesses. Understanding SBA loan rates in 2026 is crucial for owners like Sarah who seek growth without financial strain.

Decoding SBA Loan Rates in 2026

SBA loan rates are a focal point for North Carolina business owners planning their financial future. In 2026, these rates are influenced by various factors including economic conditions and federal policies. Understanding these elements helps businesses make informed decisions.

The rates typically range from 5% to 8%, depending on the loan type and term length. Fixed rates offer stability, while variable rates might be lower initially but can fluctuate. It’s essential to evaluate which suits your business strategy best.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

- Fixed Rates: Offer predictability for long-term planning.

- Variable Rates: May start lower but can increase with market changes.

Why North Carolina Businesses Benefit

North Carolina’s diverse economy, from tech hubs in Durham to agricultural enterprises in Asheville, creates unique challenges and opportunities. SBA loans provide a flexible financial solution for businesses across various sectors.

Credit score requirements are typically around 650 or higher, accessible for many small business owners. The approval process usually takes 30 to 60 days, allowing for strategic planning without prolonged uncertainty.

Common Mistakes to Avoid

Despite the benefits, North Carolina entrepreneurs often make avoidable mistakes with SBA loans:

- Not thoroughly understanding loan terms.

- Overlooking the importance of a solid business plan.

- Ignoring the impact of fluctuating rates on cash flow.

- Failing to consult financial advisors for personalized guidance.

Case Study: A Wilmington Success Story

Consider Jane, who owns a thriving seafood restaurant in Wilmington. Facing seasonal cash flow challenges, she secured an SBA loan at a 6% fixed rate. With $150,000, she revamped her marketing strategy and expanded her patio dining area. Her revenue increased by 20% in the first year, showcasing the potential of strategic SBA loan use.

FAQs for North Carolina Business Owners

Here are some common questions from business owners in North Carolina:

- What are the current SBA loan rates? Rates range from 5% to 8% depending on the loan type.

- How do I qualify? A credit score of 650 or higher is usually required.

- How long does approval take? Typically 30 to 60 days.

- Can I use the loan for any business expense? Yes, but it must be a legitimate business expense.

- What if my credit score is below 650? Consider improving your credit or seeking alternative financing.

- How do market conditions affect rates? Economic shifts can influence variable rates, so staying informed is key.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

Get The SBA Express Loan Application in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Simplifying the SBA Express Loan Application Process in…

Read more →

Get SBA 7(a) or 504 loan in New York Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read SBA 7(a) vs 504 Loans: Navigating Business Financing…

Read more →

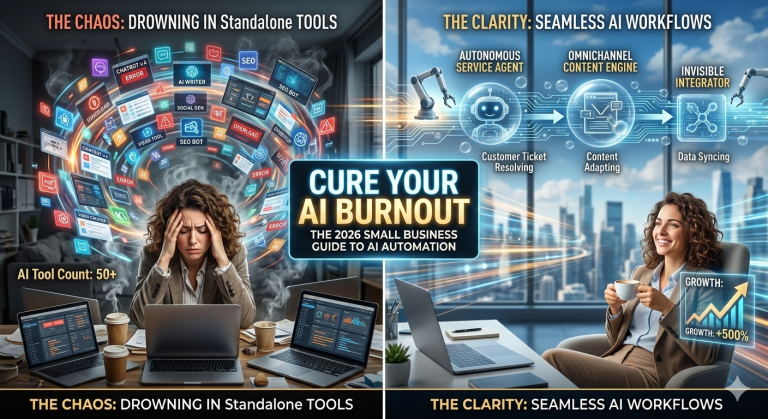

2026 Guide to AI for Small Business: Tools & Scaling Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 6 minutes read The 2026 Guide to…

Read more →

DSCR Loan Calculator with Taxes in New York Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Business Potential: Understanding…

Read more →

The Entrepreneurial Finance in 2026: Liquidity & AI Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 4 minutes read The New Rules of…

Read more →

Get The Entrepreneurial Finance Trends 2026 Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 8 minutes read Entrepreneurial Finance Trends 2026:…

Read more →Take the Next Step with GHC Funding

Ready to explore SBA loans for your North Carolina business? Contact GHC Funding for expert guidance tailored to your unique needs. Our team is here to help you navigate the complexities of SBA loan rates in 2026, ensuring your business thrives in the ever-evolving economic landscape.

“`

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources