Contributing Author & Editorial Review

This article was crafted and reviewed by experienced professionals to ensure accuracy and practical insight.

SBA 7(a) & 504 Highlights

- Loan amounts from $100,000 up to $15 million+ (program-dependent).

- Up to 90% financing for eligible acquisitions, real estate, and equipment.

- Use funds for working capital, refinance, expansion, and partner buyout.

- Longer terms (up to 25 years on real estate) to keep payments manageable.

Navigating SBA Loan Requirements for Startups in Florida: A Comprehensive Guide

When Maria, a budding entrepreneur from Miami, decided to launch her artisanal coffee shop, she faced the daunting task of securing financing. Like many Florida business owners, Maria turned to SBA loans, hoping they could bridge the gap between her dream and reality. But with so much information out there, understanding the requirements felt overwhelming.

Understanding SBA Loans for Startups in Florida

For startups in Florida, securing an SBA loan can be a game-changer. These loans are designed to support small businesses that might not qualify for traditional financing. They offer lower interest rates and longer repayment terms, making them an attractive option for entrepreneurs.

Florida, with its bustling cities like Miami, Orlando, and Tampa, provides a fertile ground for startups. However, each city presents unique challenges, from varying market conditions to competition levels. Understanding SBA loan requirements is crucial for navigating these challenges effectively.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

- Credit Score: A minimum credit score of 640 is generally required.

- Approval Time: The process can take 30 to 90 days, depending on the complexity of the application.

- Common Mistakes: Incomplete paperwork, overestimating cash flow, neglecting a solid business plan.

Case Study: A Success Story from Tampa

Consider John, who launched a tech startup in Tampa. He secured a $150,000 SBA loan, which allowed him to invest in necessary technology and hire a small team. Within a year, his revenue grew by 50%, showcasing the potential impact of SBA loans when utilized effectively.

Frequently Asked Questions

- What is the minimum credit score for an SBA loan? Typically, a score of 640 or higher is recommended.

- How long does the approval process take? It can range from 30 to 90 days.

- Can I use an SBA loan for any business expense? Yes, from equipment purchases to working capital.

- What if my credit score is below 640? Consider improving your score or exploring other financing options.

- Do I need a business plan? Absolutely. A solid business plan is crucial for approval.

- Are there any fees involved? Yes, there are typically guarantee fees involved.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

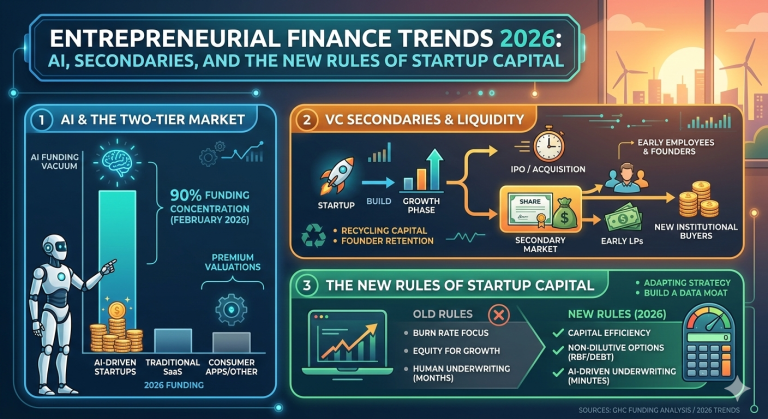

The Entrepreneurial Finance in 2026: Liquidity & AI Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 4 minutes read The New Rules of Entrepreneurial Finance 2026: Liquidity,…

Read more →

Get The Entrepreneurial Finance Trends 2026 Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 8 minutes read Entrepreneurial Finance Trends 2026: AI, Secondaries, and the…

Read more →

Best DSCR Lenders in Mississippi Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 3 minutes read Top DSCR Lenders for Real Estate Investors in…

Read more →

The Construction Loan Interest Rates in Mississippi Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 4 minutes read Understanding Construction Loan Interest Rates in Mississippi: A…

Read more →

Get DSCR Loan Calculator in Texas Now

GHC Funding Website Published: March 4, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Business Potential: Understanding the DSCR Loan Calculator…

Read more →

The Small Business Startup Costs by Industry Now

Explore small business startup costs by industry and discover insights to escape corporate life and launch your venture.

Read more →Take the Next Step with GHC Funding

Ready to turn your Florida startup dreams into reality? Contact GHC Funding today. Our team of experienced financial advisors is here to guide you through the SBA loan process, ensuring you have the support you need every step of the way.

Contact GHC Funding now and let us help you secure the financing your business deserves.

“`

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources