Contributing Author & Editorial Review

This article was authored and professionally reviewed to provide accurate, actionable financial insights.

GHC Funding

Contributing Author

Alyssa writes about real estate investing, debt-free strategies, and emerging trends in small business finance with a focus on practical insights.

Samantha Reyes

Senior Content Editor

Samantha specializes in editorial strategy, compliance review, and refining complex finance topics into accessible, reader-friendly guidance.

Construction & Renovation Highlights

- Financing for ground-up builds and major rehab projects.

- Works for SFR, small multifamily, and select mixed-use/commercial.

- Up to 85–90% of project costs and 70–75% of completed value (case-by-case).

- Interest-only during the build phase for improved cash flow.

Understanding Construction Loan Interest Rates in North Carolina: A Guide for Business Owners

Imagine you’re Jane, a small business owner in Charlotte, North Carolina. You’ve just secured a prime location for your new café, but there’s one catch: it’s an empty shell. To transform this space into your dream café, you need a construction loan. As you start researching, the maze of interest rates and terms feels overwhelming. If this sounds like your situation, you’re not alone.

- Understanding Construction Loan Interest Rates in North Carolina: A Guide for Business Owners

- What Are Construction Loan Interest Rates?

- The North Carolina Advantage

- Understanding Credit Score Requirements

- Approval Timelines

- Common Mistakes to Avoid

- Case Study: A Success Story in Raleigh

- Frequently Asked Questions

- Contact GHC Funding Today

What Are Construction Loan Interest Rates?

Construction loan interest rates are the costs you incur for borrowing funds to finance your construction project. These rates are typically higher than traditional mortgage rates due to the increased risk lenders take on. In North Carolina, rates can vary based on factors such as the borrower’s credit score, the size of the project, and the lender’s policies.

- Higher risk equals higher interest rates.

- Rates vary between lenders.

The North Carolina Advantage

North Carolina offers a unique blend of thriving urban centers and growing rural areas, making it an attractive location for construction projects. Cities like Raleigh, Durham, and Greensboro are experiencing rapid growth, leading to increased demand for commercial spaces.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

Business owners in North Carolina benefit from competitive interest rates compared to the national average. However, navigating these rates requires a clear understanding of the local market conditions.

Understanding Credit Score Requirements

To secure a construction loan in North Carolina, a good credit score is essential. Lenders typically look for scores above 680 to offer favorable rates. A score below this threshold might still qualify you for a loan, but expect higher interest rates.

Approval Timelines

Approval for construction loans can be a lengthy process. In North Carolina, it often takes between 30 to 60 days. This timeline can vary based on the complexity of the project and the efficiency of the lender.

Common Mistakes to Avoid

Many North Carolina business owners make avoidable errors when applying for construction loans. Here are a few:

- Not having a detailed project plan.

- Ignoring the importance of a good credit score.

- Underestimating the total project cost.

- Choosing a lender without comparing multiple options.

Case Study: A Success Story in Raleigh

Consider the story of Tom, a business owner in Raleigh. He wanted to build a new office space and needed a construction loan. With a credit score of 720, he secured a loan at an interest rate of 5.5%. By having a detailed project plan and a reputable contractor, Tom completed his project on time and within budget.

Frequently Asked Questions

Here are some common questions North Carolina business owners ask about construction loans:

- What is the average interest rate for construction loans in North Carolina?

Rates typically range from 4.5% to 6.5%, depending on credit scores and project specifics. - Can I get a construction loan with a low credit score?

Yes, but expect higher rates and more stringent terms. - How is the loan amount determined?

It’s usually based on the projected value of the completed project. - What are the typical terms of a construction loan?

Terms often range from 6 months to 2 years. - Do I need to make payments during construction?

Yes, typically interest-only payments. - Can I convert a construction loan to a mortgage?

Yes, many lenders offer this option.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

SBA loan rates 2026 in Arkansas Now

GHC Funding Website Published: February 10, 2026 Categories: blog Reading Time: 3 minutes read Understanding SBA Loan Rates in 2026: A Guide…

Read more →

Best DSCR Lenders for Real Estate Investors in Arkansas

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Real Estate Opportunities: Best DSCR Lenders for…

Read more →

Construction Loan Interest Rates Today in Arkansas Now

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 4 minutes read Understanding Construction Loan Interest Rates in Arkansas: A…

Read more →

SBA 7(a) vs 504 Loan Differences in Arkansas Now

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 4 minutes read SBA 7(a) vs 504 Loans: Choosing the Right…

Read more →

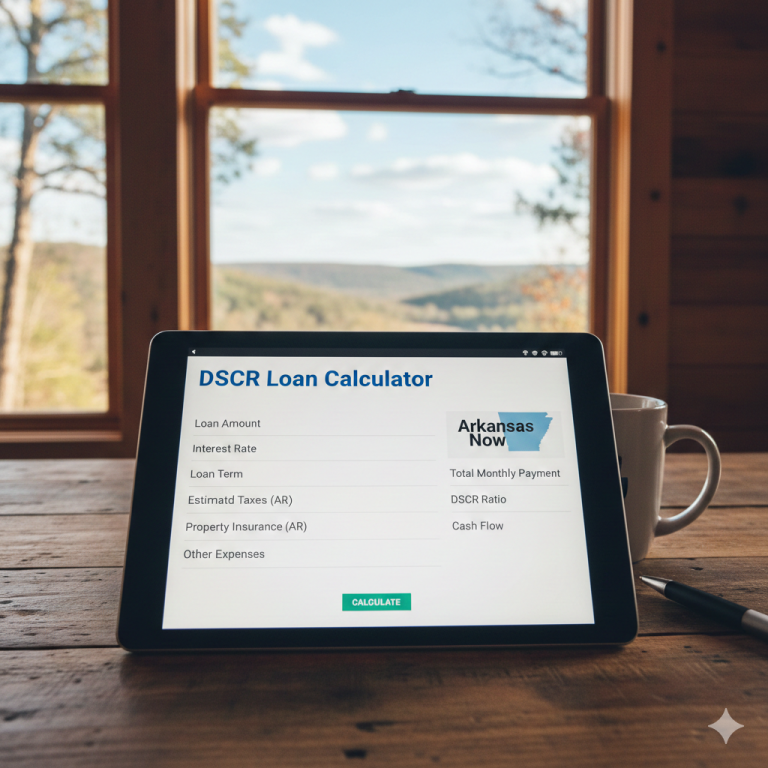

DSCR Loan Calculator with Taxes in Arkansas Now

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Financial Opportunities: Understanding the DSCR Loan Calculator…

Read more →

How to Get a Construction to Permanent Loan in Arkansas

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 4 minutes read Unlocking Opportunities: How to Get a Construction to…

Read more →Contact GHC Funding Today

If you’re ready to embark on your construction project in North Carolina, or if you have more questions, contact GHC Funding. Our team of experts is ready to guide you through the loan process and help you secure the best rates. Email us today to get started on making your dream project a reality.

“`

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources