Contributing Author & Editorial Review

This article was crafted and reviewed by experienced professionals to ensure accuracy and practical insight.

DSCR Rental Loan Highlights

- Qualification based mainly on property cash flow (DSCR).

- No personal income docs required for many programs.

- Financing for 1–8 unit rentals, portfolios, and many STR/Airbnb deals.

- Up to 80% LTV on purchases and 75% LTV on cash-out (program-dependent).

- 30-year fixed and interest-only options available.

Best Way to Pay Off High Interest Credit Card Debt Fast in 2026

Managing high-interest credit card debt can be challenging, but with the right strategies, Chicago residents can achieve financial freedom in 2026. This guide provides practical solutions and tips tailored to local conditions.

Understanding High-Interest Debt

High-interest credit card debt can quickly spiral out of control. Interest rates in 2025 averaged 18%, which can lead to significant financial strain.

Effective Strategies for Debt Payoff

- Debt Snowball Method: Focus on paying off the smallest debts first to gain momentum.

- Debt Avalanche Method: Prioritize debts with the highest interest rates to save on interest.

Consolidation Options

Consider consolidating debts into a single, lower-interest payment. This can be achieved through personal loans, balance transfer credit cards, or home equity loans.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

Local Lending Options

Chicago offers a variety of local lenders and credit unions with competitive rates for consolidation loans. Research and compare options to find the best fit.

Case Studies

Jane, a Chicago resident, successfully used a debt consolidation loan to reduce her monthly payments by 30%. By consolidating her ,000 debt, she improved her credit score and saved on interest.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

SBA loan rates 2026 in Arkansas Now

GHC Funding Website Published: February 10, 2026 Categories: blog Reading Time: 3 minutes read Understanding SBA Loan Rates in 2026: A Guide…

Read more →

Best DSCR Lenders for Real Estate Investors in Arkansas

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Real Estate Opportunities: Best DSCR Lenders for…

Read more →

Construction Loan Interest Rates Today in Arkansas Now

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 4 minutes read Understanding Construction Loan Interest Rates in Arkansas: A…

Read more →

SBA 7(a) vs 504 Loan Differences in Arkansas Now

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 4 minutes read SBA 7(a) vs 504 Loans: Choosing the Right…

Read more →

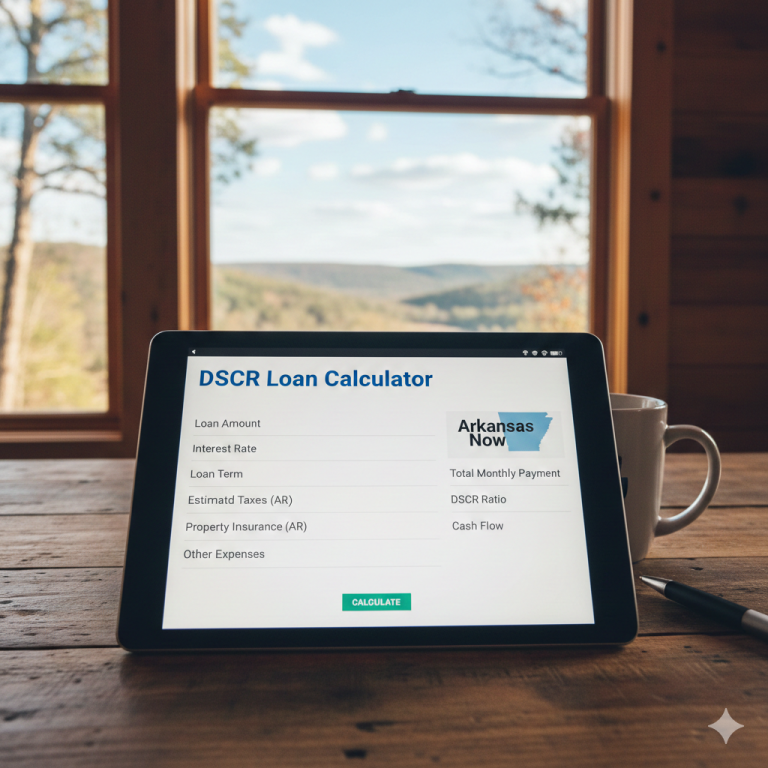

DSCR Loan Calculator with Taxes in Arkansas Now

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Financial Opportunities: Understanding the DSCR Loan Calculator…

Read more →

How to Get a Construction to Permanent Loan in Arkansas

GHC Funding Website Published: February 9, 2026 Categories: blog Reading Time: 4 minutes read Unlocking Opportunities: How to Get a Construction to…

Read more →Conclusion

With the right approach, paying off high-interest credit card debt in 2026 is achievable. Utilize local resources, consider consolidation options, and choose a strategy that fits your financial situation.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources