Contributing Author & Editorial Review

This article was authored and professionally reviewed to provide accurate, actionable financial insights.

GHC Funding

Contributing Author

Alyssa writes about real estate investing, debt-free strategies, and emerging trends in small business finance with a focus on practical insights.

Samantha Reyes

Senior Content Editor

Samantha specializes in editorial strategy, compliance review, and refining complex finance topics into accessible, reader-friendly guidance.

DSCR Rental Loan Highlights

- Qualification based mainly on property cash flow (DSCR).

- No personal income docs required for many programs.

- Financing for 1–8 unit rentals, portfolios, and many STR/Airbnb deals.

- Up to 80% LTV on purchases and 75% LTV on cash-out (program-dependent).

- 30-year fixed and interest-only options available.

Unlocking Opportunities with DSCR Commercial Real Estate Loans in Iowa

When Emily Johnson opened her boutique in Des Moines, she never imagined that rapid growth would lead to needing a larger space. Facing the complexities of commercial real estate financing, Emily turned to a DSCR loan, transforming her business trajectory. Like many Iowa business owners, she discovered a path to expansion without the traditional constraints of commercial lending.

- Unlocking Opportunities with DSCR Commercial Real Estate Loans in Iowa

- Understanding DSCR Commercial Real Estate Loans

- Why Iowa Businesses Benefit from DSCR Loans

- Essential Details for Iowa Business Owners

- Case Study: Expanding in Cedar Rapids

- Frequently Asked Questions

- Take the Next Step with GHC Funding

Understanding DSCR Commercial Real Estate Loans

DSCR (Debt Service Coverage Ratio) loans are designed for business owners who want to invest in commercial real estate without depending solely on personal income. This type of loan evaluates the property’s cash flow, making it accessible for businesses with varied income streams.

In simple terms, a DSCR loan focuses on the property’s ability to generate income rather than your personal financial status. This is particularly beneficial for Iowa businesses looking to expand or invest in new properties.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

- Focuses on property cash flow

- Less emphasis on personal income

- Ideal for growing businesses

Why Iowa Businesses Benefit from DSCR Loans

Iowa’s vibrant cities like Cedar Rapids, Davenport, and Sioux City are experiencing economic growth. Local business owners face the challenge of scaling operations in a competitive real estate market.

With a DSCR loan, Iowa businesses can:

- Access funds based on property income potential

- Invest in high-demand areas

- Reduce reliance on personal credit

The market conditions in Iowa favor those who can act swiftly. A DSCR loan provides the flexibility needed to seize opportunities.

Essential Details for Iowa Business Owners

Before applying for a DSCR loan, consider these critical factors:

Credit Score Requirements: While traditional loans require high credit scores, DSCR loans are more lenient. Typically, a score of 620 or higher is acceptable.

Approval Time: On average, approval takes 30 to 45 days, allowing business owners to plan accordingly.

Avoid these common mistakes:

- Underestimating property expenses

- Overlooking potential income fluctuations

- Failing to prepare adequate documentation

- Ignoring local market trends

Case Study: Expanding in Cedar Rapids

Consider John, who owns a successful restaurant in Cedar Rapids. Seeking to open a second location, he used a DSCR loan to finance the new property. The property generated $150,000 annually, with a DSCR of 1.25, meeting the lender’s criteria. This strategic move increased his revenue by 40% within the first year.

Frequently Asked Questions

Here are common queries Iowa business owners have about DSCR loans:

- What is a good DSCR ratio? Generally, a ratio of 1.25 or higher is preferred.

- Can I use a DSCR loan for property renovation? Yes, as long as the property can generate income post-renovation.

- Do I need a personal guarantee? Often, no personal guarantee is required.

- What types of properties qualify? Retail, office spaces, and multi-family units are common choices.

- Are there prepayment penalties? This depends on the lender; some may apply.

- How is DSCR calculated? By dividing the property’s net operating income by its debt obligations.

DSCR Loan IQ Quiz!

Test your knowledge of Debt Service Coverage Ratio (DSCR) loans!

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

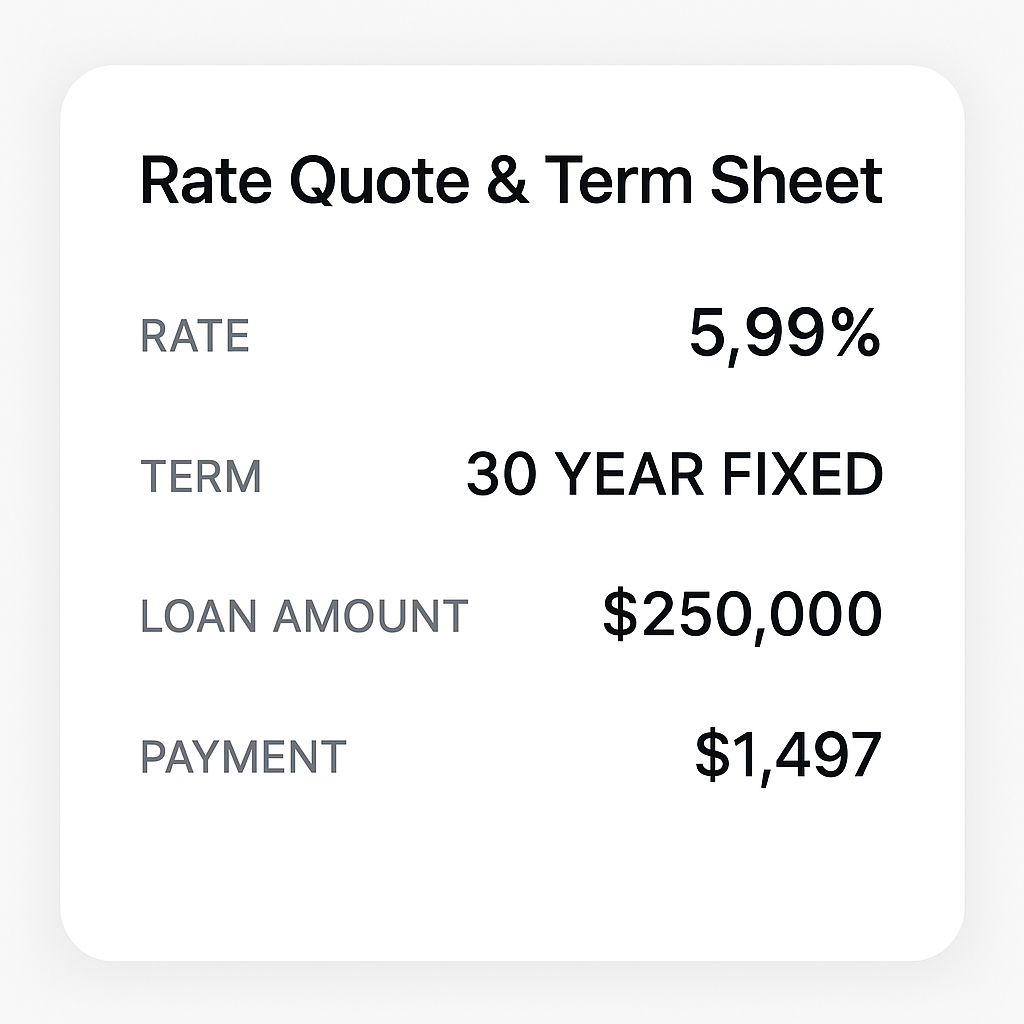

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

DSCR Loans in Mississippi for Business Owners Now

GHC Funding Website Published: December 14, 2025 Categories: blog Reading Time: 6 minutes read DSCR Loans in Mississippi: Helping Businesses Thrive in…

Read more →

SBA 504 Refinance in Mississippi for Business Now

GHC Funding Website Published: December 14, 2025 Categories: blog Reading Time: 3 minutes read Unlocking Opportunities: SBA 504 Refinance Rules in Mississippi…

Read more →

SBA Loans in Mississippi for Business Owners Now

GHC Funding Website Published: December 14, 2025 Categories: blog Reading Time: 6 minutes read SBA Loans in Mississippi: A Guide for Small…

Read more →

Balance Transfer Credit Card in Mississippi for Business Now

GHC Funding Website Published: December 14, 2025 Categories: blog Reading Time: 7 minutes read Balance Transfer Credit Card Offers in Mississippi: A…

Read more →

CMBS Loan Refinance and Maturity in Mississippi Now

GHC Funding Website Published: December 14, 2025 Categories: blog Reading Time: 3 minutes read Understanding CMBS Loan Refinance and Maturity for Mississippi…

Read more →

The Debt Snowball vs. Debt Avalanche in Mississippi Now

GHC Funding Website Published: December 14, 2025 Categories: blog Reading Time: 8 minutes read Debt Snowball vs. Debt Avalanche: Which is the…

Read more →Take the Next Step with GHC Funding

Ready to explore how a DSCR loan can benefit your Iowa business? Contact GHC Funding today. Our team of experts is here to guide you through every step, ensuring your business reaches its full potential in the thriving Iowa market.

“`

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources