Contributing Author & Editorial Review

This article was crafted and reviewed by experienced professionals to ensure accuracy and practical insight.

SBA 7(a) & 504 Highlights

- Loan amounts from $100,000 up to $15 million+ (program-dependent).

- Up to 90% financing for eligible acquisitions, real estate, and equipment.

- Use funds for working capital, refinance, expansion, and partner buyout.

- Longer terms (up to 25 years on real estate) to keep payments manageable.

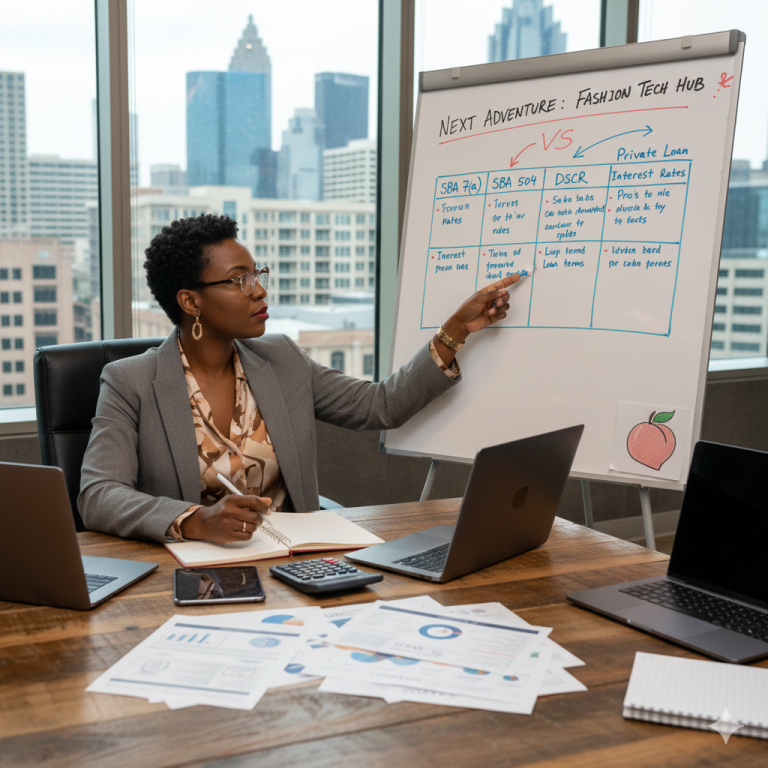

Business Financing Guide 2026 A Comprehensive Comparison for Dallas Entrepreneurs

Securing the right financing is critical to Dallas business success—whether you’re a startup, established company, or expanding enterprise. In 2025, entrepreneurs in the Dallas-Fort Worth area face a dynamic lending landscape shaped by evolving SBA policies, higher interest rates, and expansion of alternative lending options. This in-depth guide breaks down and compares SBA 7(a), SBA 504, DSCR (Debt Service Coverage Ratio) loans, private loans, and lines of credit, helping you determine the best fit for your business goals.

- Business Financing Guide 2026 A Comprehensive Comparison for Dallas Entrepreneurs

- 2026 Lending Trends & Regional Overview

- Core Business Financing Options Compared

- SBA 7(a) vs DSCR Loans: Which is Best?

- SBA 7(a) vs Conventional (Bank) Loans

- SBA 504 vs SBA 7(a): When to Use Each

- Private Loans and Lines of Credit: Flexibility for Fast Movers

- Choosing the Best Loan Type for Your Dallas Business

- Step-by-Step: How to Prepare for Financing in 2025

- ROI, Total Cost of Capital, and Cash Flow Impact

- Dallas Market Considerations

- Common Mistakes to Avoid

- Actionable Steps to Improve Loan Qualification

- Conclusion

2026 Lending Trends & Regional Overview

- Interest Rates: Federal Reserve rates stabilized at 5.25%, impacting commercial loan pricing. SBA fixed rates range from 8%-10.5% (subject to adjustments throughout 2025).

- Lending Standards: Dallas-area banks remain cautious, prioritizing strong DSCRs (1.25+) and solid collateral. However, local and regional fintech lenders have increased their profile, especially for quick-turnaround private loans.

- SBA Policy Updates: The SBA has increased 7(a) and 504 loan limits—up to $5 million for 7(a) and $5.5 million for 504—expanding access for growing Dallas enterprises.

- Economic Backdrop: Dallas’s robust job growth and low corporate tax add complexity—demand for equipment and real estate financing continues to surge, particularly in logistics, construction, healthcare, and tech sectors.

Core Business Financing Options Compared

| Loan Type | Best Use | Typical Amounts | Rates (2026) | Terms | Key Requirements |

|---|---|---|---|---|---|

| SBA 7(a) | Working capital, business acquisition, equipment, real estate | Up to $5 million | get quote. | Up to 25 years (real estate); 7–10 years (other purposes) | 680+ credit, strong cash flow, collateral (varies), U.S. business, DSCR 1.25+ |

| SBA 504 | Owner-occupied real estate, heavy equipment | Up to $5.5 million SBA portion (Total project often $15 million+) |

get quote. | 10–25 years | Business net worth <$20M, job creation or policy goals, 680+ credit, 51% occupancy |

| DSCR Loan | Investment commercial real estate (not owner-occupied) | $500K – $10 million+ | get quote. | 5–30 years (balloon or amortized) | DSCR 1.25–1.5, property cash flow, 660+ credit, 20–30% down payment |

| Private Loan | Fast capital, flexible credit situations, short-term needs | $50K – $5 million | get quote. | 6 months – 7 years | Business revenue and/or collateral, less focus on credit score |

| Line of Credit | Ongoing working capital, cash flow swings | $10K – $1 million | get quote. | Revolving (reviewed annually) | Decent credit (650+), revenue history, lower documentation |

SBA 7(a) vs DSCR Loans: Which is Best?

SBA 7(a) Overview

The SBA 7(a) is the most versatile government-backed business loan, ideal for Dallas business owners needing capital for acquisitions, working capital, equipment, or even real estate (if a majority is owner-occupied). Benefits include competitive rates, low down payments, and long terms.

DSCR Loan Overview

DSCR (Debt Service Coverage Ratio) loans are primarily offered by banks or specialty lenders for investment properties generating rental income, rather than owner-occupied business use. Approval hinges on the property’s cash flow (DSCR) rather than the business owner’s financials.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

- DSCR = Net Operating Income ÷ Total Debt Service

- Typical Dallas DSCR requirement: 1.25–1.5 in 2025

Key Differences

- Use cases: 7(a) for owner-operators; DSCR for real estate investors.

- Approval: 7(a) based on business credit and cash flow; DSCR based on property income.

- Terms: 7(a) offers longer fixed terms; DSCR may have shorter, balloon structures.

- Down payment: SBA 7(a) requires 10–20%; DSCR often 20–30% minimum.

When to Choose:

- SBA 7(a): If you operate your business out of the property, need working capital, or want a government guarantee to help secure approval at better rates.

- DSCR: If you are purchasing investment properties in the Dallas area for rental income, especially if your personal financials are not as strong but the asset cash flows well.

SBA 7(a) vs Conventional (Bank) Loans

Traditional bank loans may have slightly lower rates (typically by 1–2%) but are harder to qualify for—Dallas banks in 2025 show a preference for established, larger businesses. SBA 7(a) is more accessible for younger businesses or those lacking exceptional credit or collateral, thanks to the government guarantee. However, SBA applications are paperwork-heavy and can take longer (45–90 days) compared to select bank loans (sometimes 30–45 days if well qualified).

Case Study: Dallas Restaurant Group

A local group sought funding to refresh three locations. They opted for a $2 million SBA 7(a) loan over a conventional bank loan after the bank required 30% down and personal guarantees from all partners. The SBA’s 15% down and partial personal guarantee secured workable terms, preserving more working capital for marketing.

SBA 504 vs SBA 7(a): When to Use Each

SBA 504 loans excel for major owner-occupied real estate and heavy equipment in Dallas (such as warehouses or truck fleets). These are structured as a partnership between a bank (50%), a CDC (Certified Development Company, 40%), and the business owner (10% down).

- Pros: Lower fixed rates, 25-year amortizations, up to $5.5M on 504 portion alone.

- Cons: Limited to specific uses (at least 51% owner-occupancy), cannot finance working capital or inventory.

SBA 7(a) is more flexible, allowing for broader use—can combine real estate with other needs (inventory, operating capital).

When to Choose:

- 504: Large facility buy/renovation, Dallas businesses planning to occupy the majority of the space, and those seeking long, fixed rates.

- 7(a): Mixed-use needs (including acquisition, partner buyouts, refinancing), smaller projects, or if a business can’t meet 504’s specific eligibility.

Case Study: Dallas Manufacturing Expansion

A family-owned manufacturing firm used SBA 504 financing to buy and renovate a 60,000sf industrial building. The CDC handled 40% ($2.2M), their local bank covered 50%, and their contribution was only 10%. The 25-year fixed rate gave them predictable costs, enabling a focus on growth rather than cash flow stress.

Private Loans and Lines of Credit: Flexibility for Fast Movers

Private Loans

- Great option for Dallas businesses needing immediate capital—loans can fund in days vs. weeks or months (SBA/bank).

- Broader credit box: Helpful if your credit is below 700 or recent issues occurred. Higher rates compensate for lender risk.

- Tip: Consider private loans for short-term opportunity, then refinance to bank/SBA loans when possible.

Lines of Credit

- Essential for businesses with seasonal swings, uneven receivables, or frequent inventory purchases.

- “Use what you need” structure: You only pay interest on the funds drawn.

- Review terms carefully; in 2025, most Dallas banks offer LOCs with annual renewal and rate adjustments tied to Prime (currently 8.5%).

Case Study: Tech Services Scale-up

A Dallas-based IT consultancy landed two large contracts, requiring rapid staff onboarding and equipment buying. Unable to wait for lengthy SBA timelines, they utilized a $400K private loan at 13% for immediate needs, supplementing with a $200K business line of credit for payroll bridging. Within 12 months—and stronger books—they refinanced to a lower-rate SBA 7(a) facility, slashing interest costs by half.

Choosing the Best Loan Type for Your Dallas Business

Industry-Specific Guidance:

- Hospitality, Restaurants: SBA 7(a) for renovations and acquisition; line of credit for inventory.

- Construction & Trades: Equipment: 504 or private loan. LOC for managing project cash flow.

- Healthcare: 504 for buying clinics or large equipment, 7(a) for acquisition or expansion capital.

- Retail & Services: 7(a) for build-outs; LOC for working capital; private loan for seasonal ramps.

- Real Estate Investors: DSCR loans for passive investment properties (industrial, multifamily); raw land speculative deals may need hard money/private sources.

Loan Size and Business Age Matters

- Startups (less than 2 years): Private lenders and specialized SBA 7(a) lenders; expect to provide a strong business plan and possibly more collateral.

- Established (2+ years): All options likely available, including lines of credit, 504, DSCR for property-intensive businesses.

Step-by-Step: How to Prepare for Financing in 2025

- Pull your business and personal credit reports. Improve scores above 680 for best results.

- Organize recent tax returns, business financials (P&L, balance sheet, cash flow), interim statements, and a business plan (esp. for SBA).

- Analyze your true funding need, impact on cash flow, and your ability to service monthly obligations—calculate your DSCR scenario.

- Research Dallas-area lenders—national and regional banks, CDCs, fintechs—and compare their track record with your industry/loan type.

- Expect to personally guarantee most loans unless your company is well-capitalized and has a strong operating history.

- Watch out for “all assets” blanket liens—especially on private and some bank loans. Understand what collateral is at risk.

ROI, Total Cost of Capital, and Cash Flow Impact

- Take time to compare APR, fees, origination costs, and prepayment penalties.

- Calculate total payment over time: Even a 2% difference in interest can add up to tens of thousands on a $1 million facility over a decade.

- Factor in cash flow: Will loan payments strain operations during seasonal slowdowns? Model different scenarios before committing.

Dallas Market Considerations

- Local Lenders: Dallas-based banks (Frost, Comerica, PlainsCapital, Texas Capital) often provide better terms if they understand your business and market.

- CDCs: For 504 loans, regional Certified Development Companies drive deal structure—and may offer guidance in assembling your application.

- Alternative/Fintechs: Dallas has a vibrant private lending ecosystem for fast-track needs. Read fine print—rate hikes and fees can be a risk if not refinanced quickly.

Common Mistakes to Avoid

- Over-leveraging: Taking on more debt than the business can comfortably service, especially under variable rates.

- Ignoring prepayment penalties or covenants that restrict operations or expansion.

- Rushing into non-bank/private loans due to speed without clear exit or refinancing plan.

- Incomplete application packages: Delays or denials are common due to missing documentation—SBA is especially rigorous in 2025.

Actionable Steps to Improve Loan Qualification

- Keep tax filings current and accurate.

- Steadily improve your personal and business credit scores by reducing revolving debt and paying on time.

- Build cash reserves to demonstrate liquidity to lenders.

- Add collateral value where possible—equipment, real estate, or receivables.

- Develop relationships with Dallas-area bankers, CDC executives, and local business financing consultants.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

SBA Loan Rates in Michigan for Business Owners Now

GHC Funding Website Published: December 30, 2025 Categories: blog Reading Time: 3 minutes read Understanding SBA Loan Rates in Michigan: A 2026…

Read more →

Get Your SBA & DSCR Loan Options in Dallas Now

2026 Dallas business financing guide. Compare SBA 7(a), SBA 504, DSCR, private loans & lines of credit. Find the best loan for…

Read more →

Get SBA Express Loan Application in Oregon Now

GHC Funding Website Published: December 29, 2025 Updated: December 30, 2025 Categories: blog Reading Time: 3 minutes read Unlocking Opportunities: Navigating the…

Read more →

SBA Loans in Albuquerque Now

Get 2026 SBA loans in Albuquerque, NM. 7(a), 504, microloans & express loans. Compare rates, terms & lenders.

Read more →

Entrepreneurs Compare SBA 7(a), 504, DSCR in Atlanta Now

2026 Atlanta business financing guide. Compare SBA 7(a), SBA 504, DSCR, private loans & lines of credit. Find the best loan for…

Read more →

The DSCR Loan & Rental Investment in Miami Now

GHC Funding Website Published: December 29, 2025 Updated: December 30, 2025 Categories: blog Reading Time: 5 minutes read Maximizing Returns: DSCR Loans…

Read more →Conclusion

Choosing the right business financing in Dallas for 2025—whether SBA 7(a), 504, DSCR, private, or lines of credit—requires matching your business model, stage, and funding use with the right loan structure and lender. Analyze each option’s impact on your cash flow, growth plan, and overall cost, and never hesitate to seek expert local guidance. Done correctly, a well-chosen financing strategy is the lever that propels your Dallas business toward sustainable growth in Texas’s dynamic economy.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources