Contributing Author & Editorial Review

This article was authored and professionally reviewed to provide accurate, actionable financial insights.

GHC Funding

Contributing Author

Alyssa writes about real estate investing, debt-free strategies, and emerging trends in small business finance with a focus on practical insights.

Samantha Reyes

Senior Content Editor

Samantha specializes in editorial strategy, compliance review, and refining complex finance topics into accessible, reader-friendly guidance.

DSCR Rental Loan Highlights

- Qualification based mainly on property cash flow (DSCR).

- No personal income docs required for many programs.

- Financing for 1–8 unit rentals, portfolios, and many STR/Airbnb deals.

- Up to 80% LTV on purchases and 75% LTV on cash-out (program-dependent).

- 30-year fixed and interest-only options available.

Unlocking the Power of DSCR Loan Calculators: A New Mexico Business Owner’s Guide

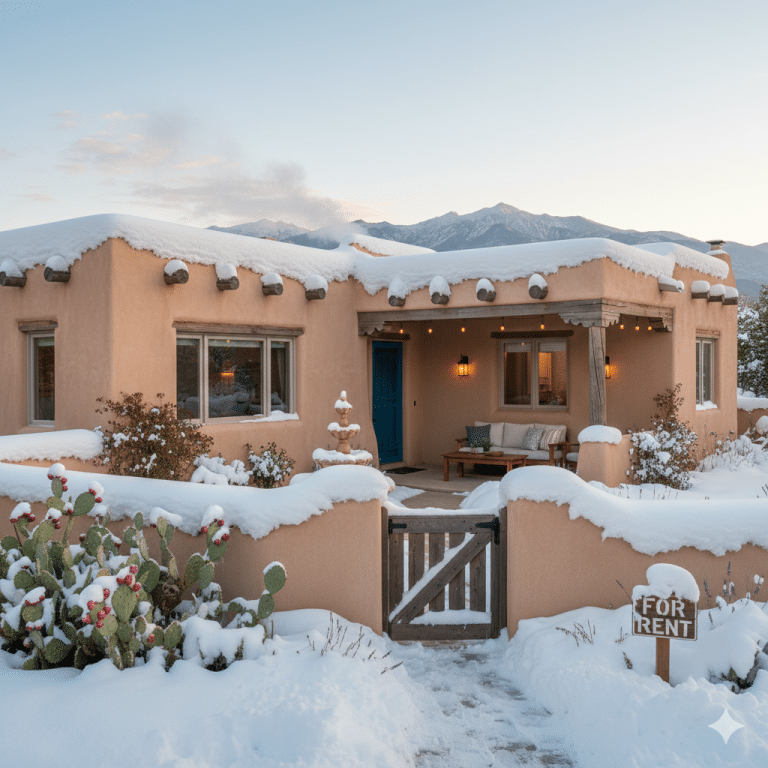

Maria, a local restaurant owner in Santa Fe, faced a dilemma. Despite her bustling business, traditional bank loans were hard to come by. She needed a solution tailored to her specific financial landscape. That’s when she discovered the DSCR loan calculator, transforming her approach to financing.

- Unlocking the Power of DSCR Loan Calculators: A New Mexico Business Owner’s Guide

- Understanding DSCR Loan Calculators with Taxes and Insurance

- Why New Mexico Businesses Benefit

- Credit Score Requirements and Approval Time

- Common Mistakes New Mexico Business Owners Make

- Case Study: A Santa Fe Success Story

- FAQ

- Ready to Transform Your Business? Contact GHC Funding Today!

Understanding DSCR Loan Calculators with Taxes and Insurance

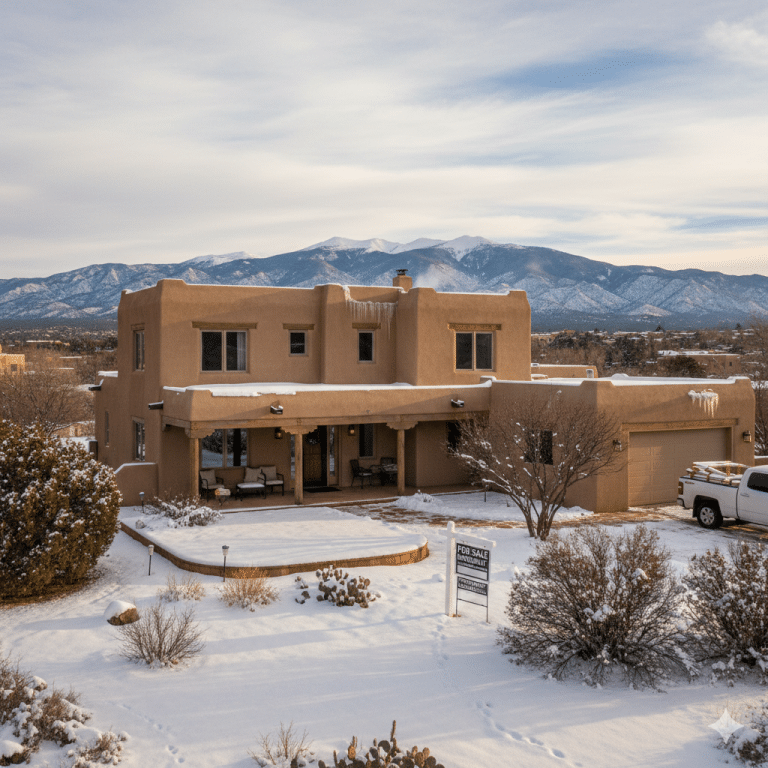

The Debt Service Coverage Ratio (DSCR) loan calculator is a crucial tool for business owners in New Mexico. It helps determine the ability of a business to cover its debt obligations, factoring in taxes and insurance. This tool is invaluable for those seeking to expand or stabilize their operations.

But who needs it? Primarily, businesses with fluctuating income or those in growth phases. By calculating DSCR, owners can understand their financial health and make informed borrowing decisions. This is particularly beneficial in New Mexico, where economic conditions can vary widely between cities like Albuquerque and Taos.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

- Albuquerque: Known for its tech startups and healthcare industry.

- Taos: A hub for tourism and arts, with seasonal income variations.

Why New Mexico Businesses Benefit

New Mexico’s diverse economy presents unique challenges. From fluctuating tourism in Taos to tech booms in Albuquerque, businesses face varying market conditions. DSCR loan calculators provide clarity by incorporating all critical expenses, ensuring that loans are manageable and sustainable.

Credit Score Requirements and Approval Time

For DSCR loans, a credit score of at least 620 is typically required. Approval times vary, but with organized documentation, it can take as little as 30 days. This quick turnaround is crucial for businesses needing immediate capital.

Common Mistakes New Mexico Business Owners Make

- Ignoring seasonal income fluctuations, especially in tourist-dependent areas.

- Underestimating tax obligations and their impact on loan eligibility.

- Failing to factor in insurance costs, leading to underfunding.

- Not consulting financial advisors for tailored advice.

Case Study: A Santa Fe Success Story

Consider a local art gallery in Santa Fe, struggling with off-season cash flow. By utilizing a DSCR loan calculator, they secured a $150,000 loan with a DSCR of 1.25. This funding allowed them to sustain operations through slow months, ultimately increasing their annual revenue by 20%.

FAQ

- What is DSCR? It stands for Debt Service Coverage Ratio, a measure of cash flow available to pay current debt obligations.

- Why include taxes and insurance? These are significant expenses that affect cash flow and loan repayment ability.

- Can startups use DSCR calculators? Yes, especially if they have some operational history to base calculations on.

- What if my DSCR is below 1? This indicates a higher risk to lenders; consider improving cash flow or reducing expenses.

- How often should I check my DSCR? Regularly, especially before taking on new debt or during financial reviews.

- Does location in New Mexico affect DSCR? Yes, local market conditions and cost structures can impact your ratio.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

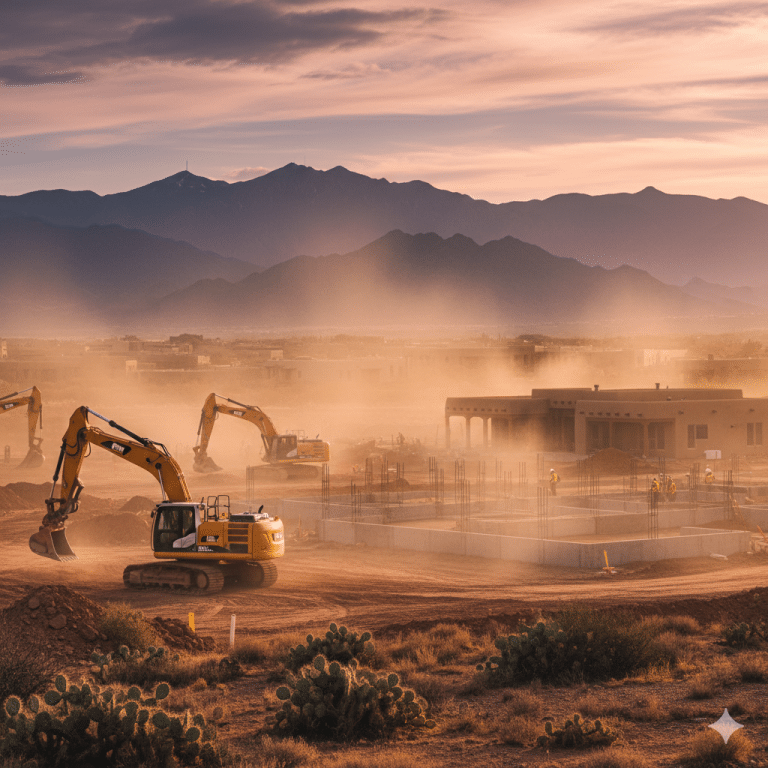

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

Best DSCR lenders for real estate investors in New Mexico

GHC Funding Website Published: February 8, 2026 Categories: blog Reading Time: 3 minutes read Best DSCR Lenders for Real Estate Investors in…

Read more →

Construction loan interest rates today in New Mexico

GHC Funding Website Published: February 8, 2026 Categories: blog Reading Time: 4 minutes read Understanding Construction Loan Interest Rates in New Mexico:…

Read more →

The SBA 7(a) vs 504 loan differences in New Mexico

GHC Funding Website Published: February 7, 2026 Updated: February 8, 2026 Categories: blog Reading Time: 3 minutes read Understanding SBA 7(a) vs…

Read more →

DSCR loan calculator, taxes and insurance in New Mexico

GHC Funding Website Published: February 7, 2026 Categories: blog Reading Time: 3 minutes read Unlocking the Power of DSCR Loan Calculators: A…

Read more →

SBA loan requirements for startups in New Mexico Now

GHC Funding Website Published: February 7, 2026 Categories: blog Reading Time: 3 minutes read Navigating SBA Loan Requirements for Startups in New…

Read more →

No Doc DSCR Loans in New Mexico Now

GHC Funding Website Published: February 7, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Investment Opportunities: No Doc DSCR Loans for…

Read more →Ready to Transform Your Business? Contact GHC Funding Today!

At GHC Funding, we specialize in helping New Mexico businesses navigate financial challenges. Whether you’re in bustling Albuquerque or scenic Taos, our experts are ready to assist. Email us or call today to explore your options with DSCR loans.

“`

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources